Bitcoin in Uncharted waters, Ordinals are kinda fun, Memecoin SZN is here | TS-007

Plus: Political memes like MAGA catching a bid, a 16M cryptopunk sale

Hey everyone

I’m writing this from a hotel lobby in Chicago after a fun trip out to LA to host the 10KTF event. It was a blast and it’s always great to catch up with internet friends IRL. Highly recommend

TOP SIX STORIES IN CRYPTO

BTC nears all time high, months before the halving (a first)

Bitcoin ETF inflows dwarfs new bitcoin production 10:1

Mog, Pepe, Wif, Bonk: Meme coin SZN is here

Ordinals (Bitcoin NFTs) are heating up

Political Memes: MAGA Surging as election year progresses

$16M Alien CryptoPunk buy, the second highest Punk purchase ever

1. BTC nears all time high, months before the halving (a first)

Bitcoin hit $67K USD this morning and we’re in uncharted territory. For the first time ever, Bitcoin is nearing its all time high ($69K USD) months before the halving. This is a major pattern break - no one knows what comes ahead. Let me explain.

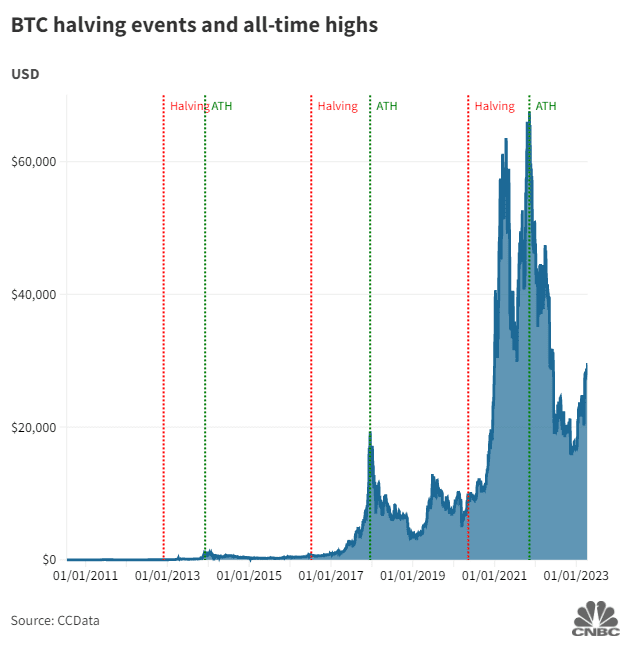

In every Bitcoin bull cycle so far, the halving (aka when miner BTC rewards are halved) caused a supply shock. This supply shock would take months to play out until the price absolutely soared and Bitcoin would hit an all time high. The halving came before the ATH - it happened in 2013, in 2017, and 2021. But this time, things are different (really).

We’re still 2 months away from the halving - the supply shock that’s supposed to cause a price surge. And yet, BTC is only $2K USD away from it’s previous ATH. In a normal cycle, this kind of price action was expected between September - December 2024.

So why is this happening? Well, the answer is obvious: the BTC ETFs. They have really changed the game for Bitcoin and history is being made - this isn’t an exaggerration. February 2024 was the largest close in Bitcoin history. What comes next? No one knows. Strap in.

2. Bitcoin ETF inflows dwarfs new bitcoin production ~10:1

Speaking of the ETF, here’s how they are doing. A stat from last week showed that ~10,500 Bitcoin was purchased by ETFs. That same day, miners produced ~900 Bitcoin. That’s approximately a 10:1 ratio - and if the ETF volume keeps up, by the time the halving takes place in May 2024 where new bitcoin production will be cut in half, this ratio could bubble to 20:1.

Whatever price prediction you have for Bitcoin this cycle, you must reassess in light of this inflow data. and whether BlackRock and Co continue to buy BTC at this rate is anyones guess - I have a feeling they will.

3. Mog, Pepe, Wif, Bonk: Meme coin SZN is here

As BTC and ETH are surging, so are memecoins. The four main ones on my radar are: Mog, Pepe, Wif and Bonk. Some quick stats:

Mog: $250M Marketcap, up 4x from last week

Pepe: $3B Marketcap, up 6x from last week

Wif: $1.4B Marketcap, up 4x from last week

Bonk: $2.56B Marketcap, up 3.5x from last week

What each of these coins have in common is a rabid community on CT, and thousands of holders. These memes also have been around for a fairly long time (think 6 months - 1.5 years, which is forever in memecoin terms). So, their resurgence isn’t all that surprising. All four memecoins were trading flat for most of 2024. What has caused this massive spike in price is the bullish sentiment returning to crypto. As the sentiment returned, so did capital, and some of that is being allocated to memecoins. Some are calling this the “memecoin supercycle”. We could be entering a golden age of it - where thinly veiled cash grab attempts dressed up as “serious” projects no longer catch the attention of Crypto Twitter.

Instead, we all know the game: coins are a giant ponzi, so let’s cut the fancy whitepapers, the sexy websites, and let’s definitely cut out the VCs.

Crypto Twitter is bidding on memecoins this cycle.

We know it’s dumb.

We don’t care.

Higher.

4. Ordinals (Bitcoin NFTs) are heating up

As ETH continues to surge in price, ETH NFTs continue to slide (Pudgy penguins and BAYC are down 5-10% in the last week). But as BTC continues its upward march to it’s ATH, Bitcoin NFTs (aka Ordinals) are also surging. Many are up 50% in the last week and the trend isn’t slowing down.

The case for Bitcoin NFTs is obvious: it’s the largest blockchain with the deepest liquidity. Where I think ETH NFTs went wrong was to turn them into venture backed businesses with holders demanding “utility”. Ordinals appear to be just the JPEG - while there are perks of being a holder coming in the form of whitelists, and a community, there’s no “NodeMonkey Fest” planned, not do I think there ever will be. There are also no royalties on Ordinals (traders do pay the 2.5% Magic Eden fee). This reminds many of us of the crazy NFT summer of 2021.

Ordinals are here and they’re not going anywhere. I still wont be trading my hard earned sats for jpegs (for a multitude of reasons - BTC is the final trade, massive capital gains taxes for selling), but it doesn’t hurt to bridge some funds over from another chain and play the ordinal game. There’s money to be made.

5. Political Memes: MAGA Surging as election year progresses

In a unanimous decision, the US supreme court ruled 9-0 in favour of putting trump back on the ballot in Colorado. A bipartisan ruling these days are hard to come by - but many would agree this is the right choice - including the markets.

In what is becoming the main political coin of this cycle, $MAGA surged on the supreme court ruling to new all time highs (again, just like it did after Trump won South Carolina).

The coin sits at a $430M marketcap. Early buyers put in 0.1 ETH (~300 USD), and are sitting on $2.5M now - and the election is still 6 months away. Expect political memes to continue to catch a bid. And if Trump wins in November 2024? I’m expecting a giant green candle.

6. $16M Alien CryptoPunk buy, the second highest Punk purchase ever

Just as ETH NFTs were gasping and taking their last breath (exaggeration), an offer was made to a cryptopunk - 4500 ETH or $16M USD. The owner of the alien punk accepted. This is the second most expensive punk ever sold, with the first being an alien punk with a blue bandana for 23M.

Are ETH NFTs back? Crypto Twitter seems to think so. I’m not convinced yet, the alternatives are still too fun (memecoins, ordinals), while ETH NFTs increasingly feel corporate and bloated with their high fees and royalties.

That’s all for this week - See you next time and hit the subscribe button, por fa

- atareh out