Blast is heating up (again), Plutocats experiment, 3 ways to get Blast Gold | TS-010

2 months till $BLAST launch and Blast is getting a lot of attention.

Gm, today’s newsletter is heavy on Blast - a general overview of what’s coming, an interesting NFT project (Plutocats), and 3 ways you can start to earn Blast Gold.

TOP SIX STORIES IN CRYPTO

Blast Gold is coming and the ecosystem is heating up (for real this time)

Plutocats.wtf - funding innovation on Blast

Blast Gold #1: Stake on Spacebar to earn

Blast Gold #2: Staking on Juice Finance

Blast Gold #3: Collect daily loot boxes on Blade Swap (no $$$ required)

ETH NFTs continue to underperform

1. Blast Gold is coming and the ecosystem is heating up (for real this time)

After a fairly lacklustre launch in February, Blast season is starting to heat up again (actually). The $BLAST airdrop is only 2 months away - you can get part of that airdrop by bridging eth to Blast and earn blast points passively, and/or earn Blast Gold by actively using dApps.

Pacman (Blast founder) has mentioned how valuable Blast Gold is in the ecosystem - and now we know exactly how valuable. 1 Blast Gold = 35,346 points. So, the game for the next 8 weeks is clear: maximize your Blast Gold allocation.

In this week’s edition, I’ll go over some dApps I’m using to earn Blast Gold. Some of these require capital, others require time, but both earn you the coveted Blast Gold.

2. Plutocats.wtf - funding innovation on Blast

On the surface, Plutocats is just another NFT project on Blast. They’re cute cats with noggles inspired by Nouns DAO, and they’ve gained popularity in the last week because of their large Blast Gold allocation (other NFT projects get 5,000 to allocate to their community, while Plutocats got 63,800). Add in the fact that the supply is dramatically lower than other NFT projects (~528 right now, although new cats can be minted on Plutocats.wtf) and you have an arbitrage.

Traders and Blast farmers have jumped on this - the floor has surged to 2.4 ETH as of this writing. Also as of this writing, 25% of the Blast Gold has been allocated to holders so far. But there’s a bit of a problem… what happens when all the Blast Gold is allocated (Deadline: May 2024). What happens to Plutocats (and the floor)? Well, the deeper you dive into Plutocats, the more you’ll understand that they’ll be a very important part of the Blast ecosystem as a whole - and likely also why they received an outsized Blast Gold allocation compared to other NFT projects (63,800 vs 5000).

Shaping the future of Blast

I’m in the process of writing a deep dive on Plutocats, which will be published on my Twitter later - so be sure to follow to get that. For now though, I want to present a basic question: After Blast Points run out, who will incentivize builders, creators, and innovators to continue to build on Blast? And arguably more importantly, who decides which projects get funded and which don’t?

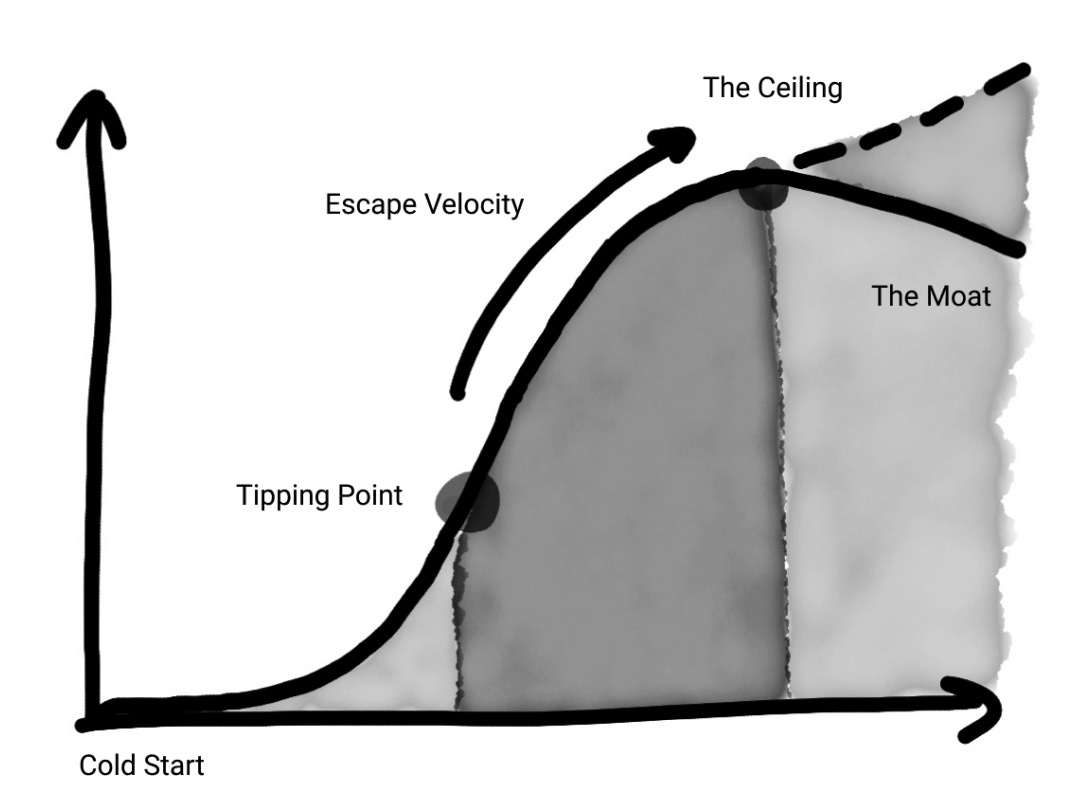

The Big Bang Blast competition, which allocated Blast Gold to developers to give out to the community, was a one-time initiative where a group of judges decided. This works fine at the beginning of a new ecosystem because the goal is to solve the “cold start problem.” Meaning, how do you get traction at the very beginning of an ecosystem/chain to attract talent to build to attract other users? Often times it’s through incentives, which is why every chain from Base, to Optimism, to Blast have a large war chest to fund builders and creators. But on most chains and ecosystems, the process to get grants is still fairly centralized to insiders.

When Pacman is no longer giving out Blast Points to builders, other mechanisms to fund them will be necessary. Other mechanisms to decide who gets funding will also be necessary (vs a centralized process prominent on many other chains).

That’s the basic idea of the Plutocats - it’s a DAO. It’s aim is to get a group of early Blast big brains together who will help steward the future of Blast by funding builders. Unlike other DAOs though, the ETH in the DAO reserves are never used to fund builders. Rather, Plutocats is capitalizing on Blast’s innovation: native yield. In NounsDAO, members are managing the ETH treasury, which is made up of everyone who minted a Noun. In Plutocats, the treasury is never spent, members are instead managing the yield the reserves accumulate (5-7% APY).

The founders of Plutocats - Wiz and TM0B1L - have taken a lot of inspiration and learnings from their time at NounsDAO. Those learnings are baked into the Plutocats protocol at the code level. An example is the “Exit mechanism” - this allows anyone to leave the Plutocats DAO at any moment and get the book value of their NFT back (total ETH in reserves/total NFTs). This is again only possible because the DAO members aren’t allocating treasury funds to builders, it’s the yield.

Right now, many people are attracted to Plutocats for their outsized Blast Gold rewards. But the vision - to help steward the future of the Blast ecosystem - is what’s going to make people stick around. If it works, Plutocats will end up as the OG NFT project on Blast. and being OG comes with social and financial capital - which is almost everything in crypto.

[Disclaimer: I hold 1 Plutocat NFT]

3. Get Blast Gold #1: Stake on Spacebar to earn

If you have no Blast Gold and want to start accumulating, Staking on Spacebar is one of the easiest ways right now. Here’s how.

When you sign up using my referral link, stake some ETH, and choose an NFT as your profile pic (this all happens in the signup flow), we both get Blast Gold. That’s it.

If you’ve already signed up for Spacebar without a referral, you can still enter it in the referral section, the code is: hHQvso. This might also get you Blast Gold, but I’m not 100% sure.

Spacebar also has a “daily check-in” you can do, which lets you earn diamonds that also count towards your total allocation. I have a reminder to check into Spacebar daily on my calendar - it takes 20 seconds. Notably, they also have a large Blast Gold allocation (224K) that they have yet to give out.

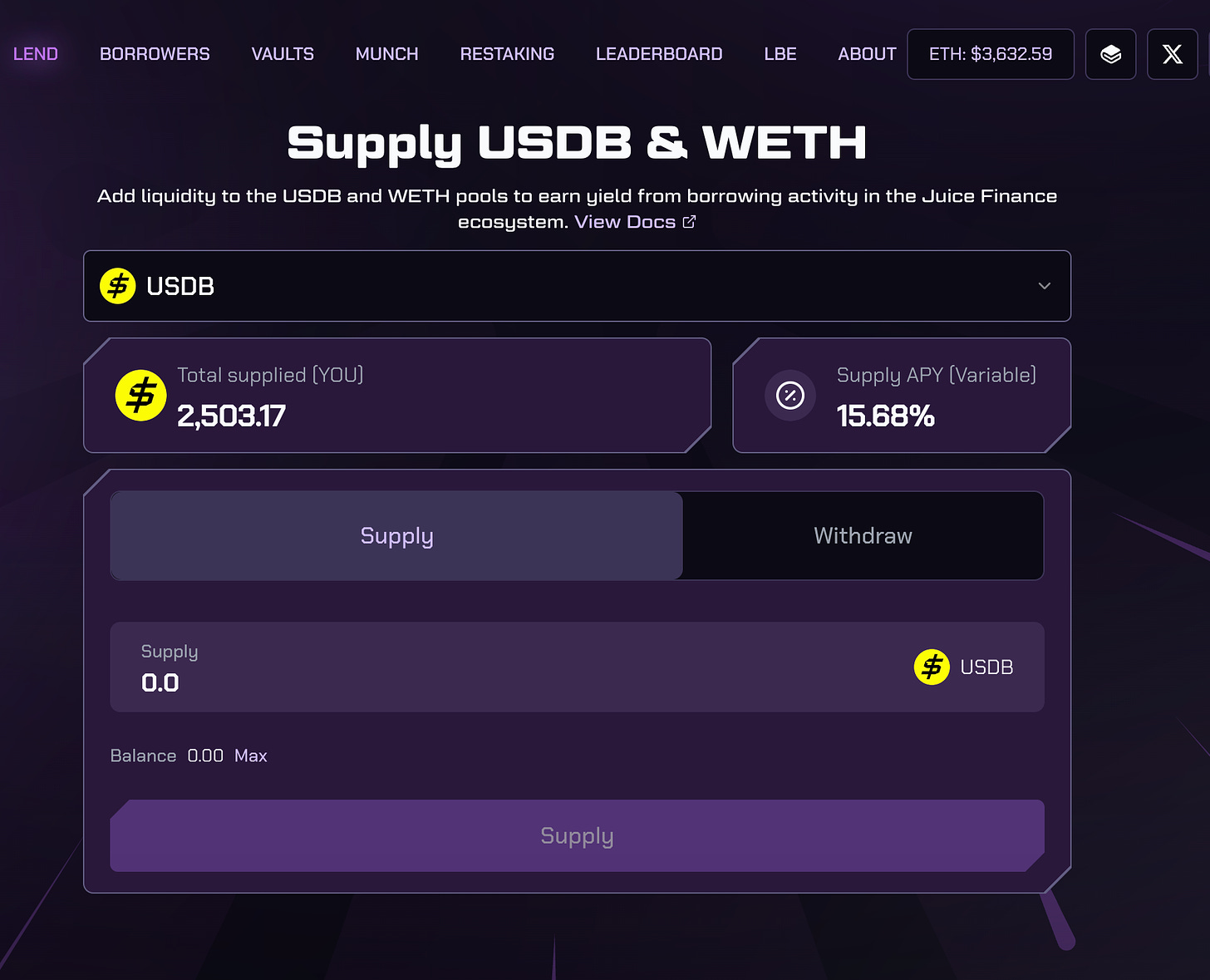

4. Get Blast Gold #2: Staking on Juice Finance

Next up is Juice Finance. It’s a borrowing and lending platform on Blast, which has a large allocation of Gold they’ve yet to give away (384K). Staking on Juice is great for people who have a lot of capital but are low on time - the more you stake, the bigger your share of Gold.

Adding my referral link here as well if you want to use that - this is a great way to earn passive yield and Blast Gold. I recommend getting started with lending USDB, which gets you 15% APY, and Blast Gold allocation. Check this spreadsheet for how Juice is allocating its Blast Gold. We love the transparency!

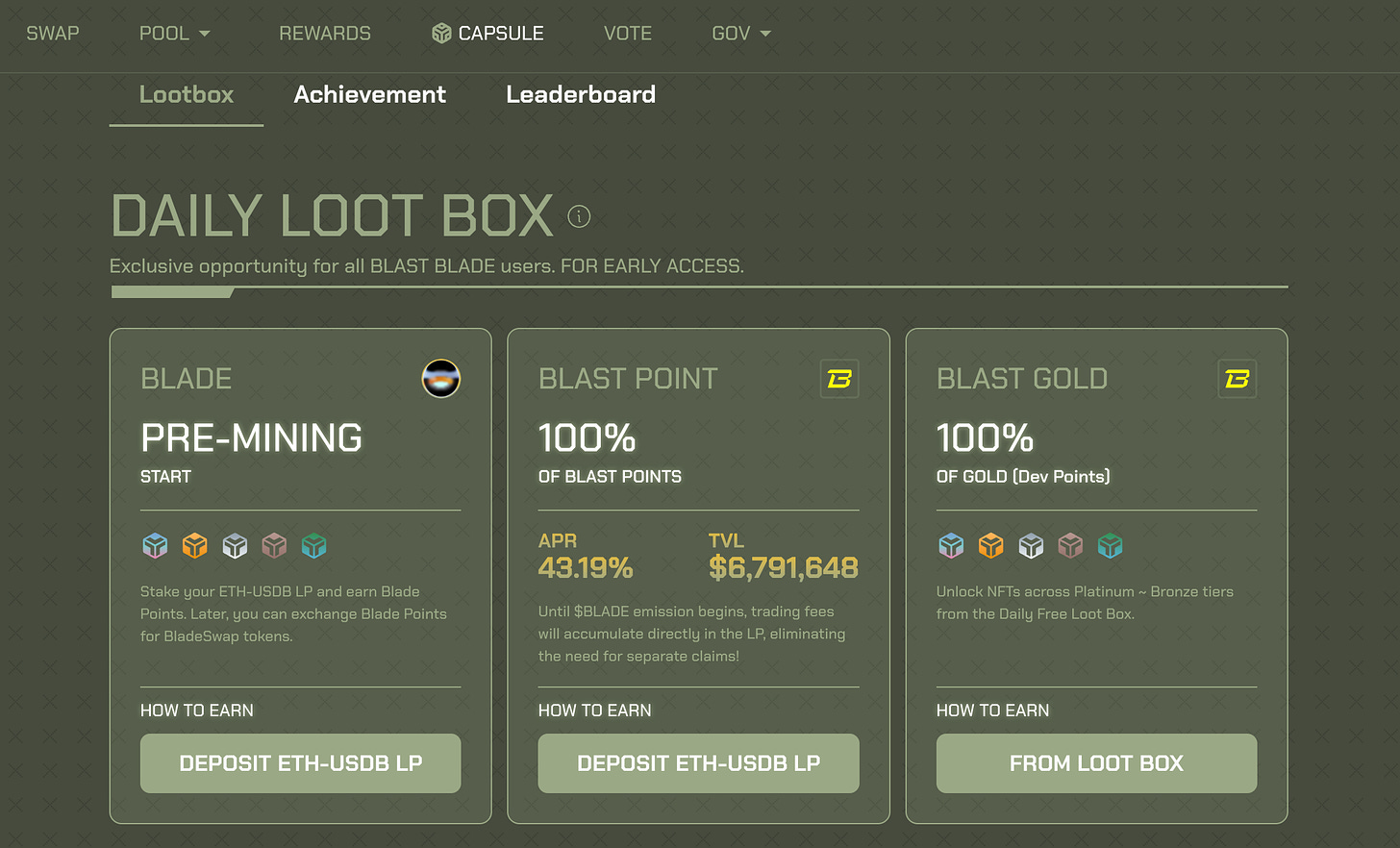

5. Get Blast Gold #3: Collect daily loot boxes on Blade Swap (no $$$ required)

If you’re low on capital, you can still earn Blast Gold. One of my favourite ways is to collect loot boxes on BladeSwap. They have 108.5K Gold to give away still, and these can only be earned through loot boxes.

On BladeSwap, navigate to “capsule in the top menu”. You’ll get to the page pictured below. The third box below describes how you get Blast Gold - which is via Loot Boxes.

To get Loot Boxes, click “get free daily loot box” on the same page. You can collect three everyday (these will require a gas transaction ($0.001) per loot box). Staking on BladeSwap increases your rank, which increases the probability of getting more rare Loot Boxes - so if you have some capital, it doesn’t hurt to stash it away here too.

Again, including my referral link here if you want to use it.

6. ETH NFTs continue to underperform

In crypto, capital flows to where there is an opportunity for it to grow.

With ETH NFTs no one has offered that in this cycle so far - so capital flows away to base, blast, ordinals, memecoins.

The value prop of “community vibes” that many ETH NFTs offer is wholly dependent on if the holders are making money.

I would bet a large part of the bored ape vibes in 2021 were based on them getting airdrops worth thousands, whitelist access and free expensive parties - with that gone, the vibes are down across the board in ETH NFTs, and people are looking to move their capital so it can get to work again.

Can ETH NFTs turn it around? We’ll see.

That was a Blast-centric newsletter - if you can’t tell I’m very bullish on Blast. As always, if you found value please share with a friend or tweet this out. Thank you for your attention.

- atareh out

Disclaimer: This commentary is provided for general informational purposes only and does not constitute financial, investment accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this commentary should consult with their advisor. All opinions and estimates expressed in this commentary are as of the date of publication unless otherwise indicated, and are subject to change. Certain information that we have provided to you may constitute “forward-looking” statements. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual results or achievements to be materially different than the results, performance or achievements expressed or implied in the forward-looking statements.