Crypto fantasy league, Blast Jackpot, Blast Gold price predictions | TS-015

Plus: Runes continue their downward slide, Questionable $2.1M ApeCoin grant, Eigenlayer fixes their airdrop distribution

pew pew pew, it’s another Blast edition - this is the top six stories in crypto by atareh

TOP SIX STORIES IN CRYPTO

Fantasy.Top takes over Twitter

Blast introduces “Jackpot”

Blast Gold price predictions

Runes continue their downward slide

$2.1M grant application enrages ApeCoin DAO members

Eigenlayer announces 100 extra $EIGEN for everyone

1. fantasy.top takes over Twitter

The first fantasy sports league for shitposters and content creators launched this past week and took over Twitter - what is Fantasy.Top? It’s a fantasy league to see who can get the most views on Twitter with their content, here’s how you play:

Create a deck of your 5 favourite crypto Twitter posters

Fantasy Top launches tournaments that last a few days

The more views your fantasy team gets on Twitter with their content, the higher you rank

Win prizes based on where you rank at the end

It’s got all the makings of a hit - the prize pool is massive, creators are incentivized to shill their cards (they get 1.5% of all sales) and post lots of content, which all culminates in Blast Gold, ETH, prize packs, fantasy points, and most important of all: bragging rights - which we know how much CT loves.

If you want to get involved, you can start here and use the code “atareh” (it’s invite only).

There are 2 games you can play on Fantasy Top - either you can collect creator cards and enter them in tournaments (collect who you think will perform well with their tweets but are underpriced), or you can buy cards, and wait for them to go up and flip.

Either way, there are profits to be made - many cards are up over the past few days as Fantasy Top has become the darling of Twitter.

2. Blast introduces “Jackpot”

The ever-crafty Pacman introduces yet another incentive layer on Blast - it’s called “Jackpot”

Every block, there is a chance for either a coin or NFT collection to win the Gold Jackpot - and to play, just add collections/coins you want to enter the Jackpot with on their website (under airdrop > gold jackpot). If that community wins, you get your share of the overall Jackpot.

So far, PacMoon and Fantasy have won the Jackpot - if you added these to the Jackpot, you got a nice Gold airdrop. It’s yet another clever incentive, and incentivizes holding assets on Blast - there are some concerns about where all the Gold is coming from, but those are questions for later - right now, we’re all trying to win Jackpot and some Gold, baby.

3. Blast Gold price prediction

In the next 3 weeks, the $BLAST token airdrop will take place - NFTStats has had the best content around what we think Blast Gold will be worth. The short answer, each Blast Gold will be worth ~$10.68 - read the full long post on Twitter below to understand how he arrived at the math (linked below, click image).

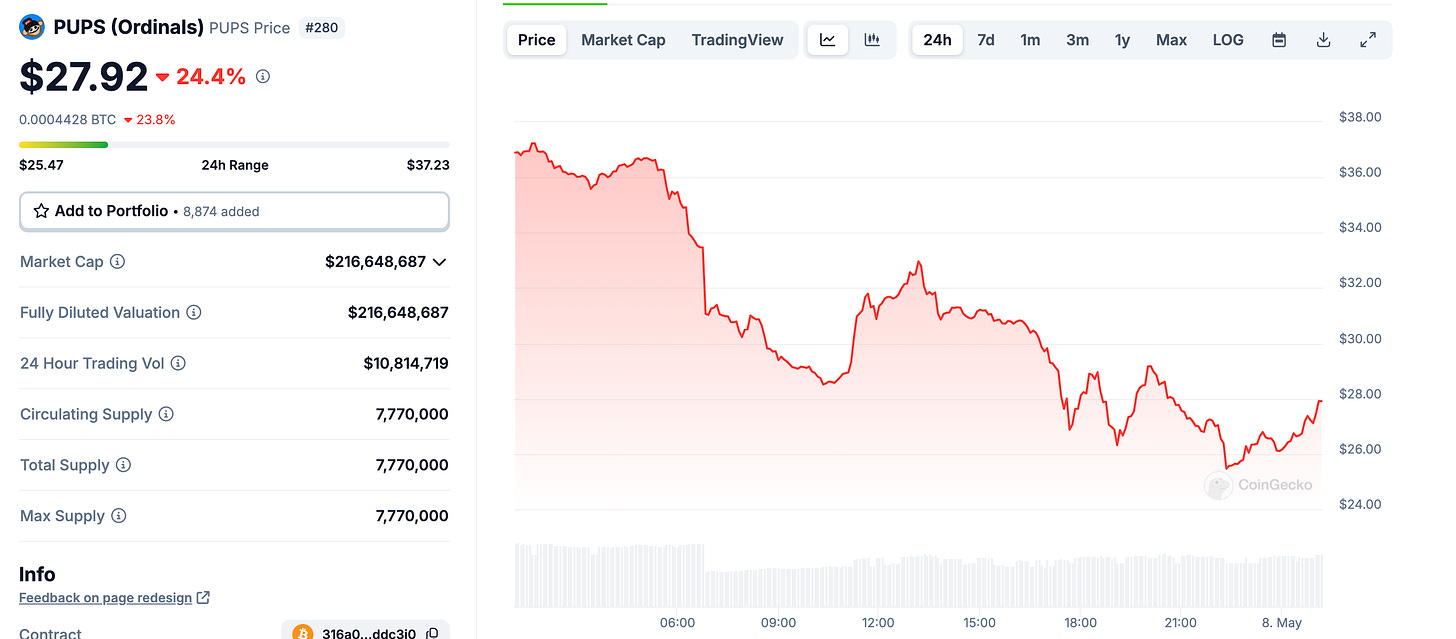

4. Runes continue their downward slide

Despite what some Ordinals influencers said, millionaires were not printed overnight for Runes. It’s been 3 weeks, and most Runes are down quite a lot from their highs leading up to the Bitcoin Halving.

The biggest complaint is still the user experience - it’s like trading NFTs but without cute pictures. There’s no instant liquidity. You have to split your lots. There’s a lot wrong with it. The idea of “memecoins on Bitcoin” sounds nice, and could work one day. But Runes trading still sucks - it’s not quick like Solana, Base or Blast, the other memecoin arenas.

Degens want instant liquidity - and liquidity pools don’t exist on Bitcoin. So, we’re at a standstill here. Runes will likely pump one day when new tech enables faster trading, but for now - they’re stuck in the gutter.

5. $2.1M grant application enrages ApeCoin DAO members

Are DAOs broken? Maybe.

This week, we saw AIP-419 ask for an egregious amount ($2.1M) for attending conferences - the cost breakdown is below.

While the AIP was on track to being passed (~56% voted yes), the added scrutiny on Twitter effectively sent the yes votes to 0 (99% are now voting against it).

Naturally, it sparked a spirited debate about whether DAOs work or not. Adam Hollander had the most cutting take - something he’s expressed before (see below).

While many disagreed, including current Special Council Member Bored Ape G (see his response here), it is true that lately in the DAO, 2 big whale wallets control whether an AIP passes or not. These are big corporations holding millions of votes in ApeCoin. ApeCoin is going through its centralization phase, and there will be many battles like this. While the outrage for AIP-419 on Twitter made those big wallets switch their votes, outlining the importance of the social side for DAOs, there is still an uphill battle.

There are still millions of dollars in the treasury and a few wallets have the power to control what is approved and what isn’t. Twitter’s attention span won’t be able to galvanize support (or protest) against every proposal. How many can these large wallets get passed without people noticing?

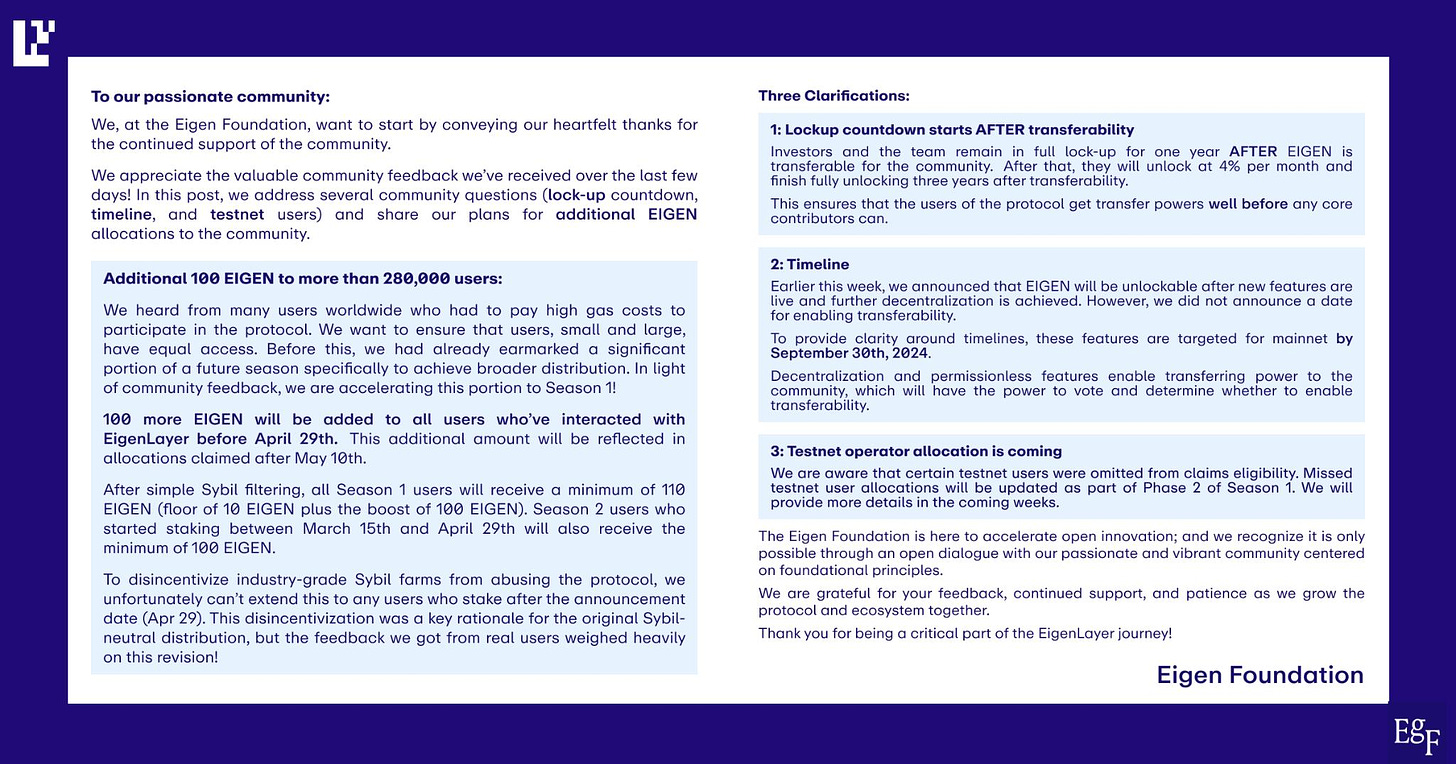

6. Eigenlayer announces 100 extra $EIGEN for everyone

Let’s round it out with some good news. Last week I reported that Eigenlayer screwed the pooch - the airdrop was massively undersized for many farmers (along with all the geoblocking issues - if you missed it, read it here).

This week, I’m happy to report that they changed some things - notably that 200k users are getting 100 $EIGEN extra. This is a sizable increase, as EIGEN is expected to be priced around $6-$10 - so this is an extra $600-$1000 that people will receive. They also clarified VC token lockups, and when people can expect to start trading their tokens (this fall).

It doesn’t address everything (namely, geoblocking), but it’s something, right?

As always, if you found value please share with a friend or tweet this out. Thank you for your attention.

- atareh

Disclaimer: This commentary is provided for general informational purposes only and does not constitute financial, investment accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this commentary should consult with their advisor. All opinions and estimates expressed in this commentary are as of the date of publication unless otherwise indicated, and are subject to change. Certain information that we have provided to you may constitute “forward-looking” statements. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual results or achievements to be materially different than the results, performance or achievements expressed or implied in the forward-looking statements.