Insider trading allegations around Yuga's Moonbirds acquistion, Yuga Town Hall takeaways | TS-005

Plus: Airdrop alert for BlastSwap, are NFTs a viable business in 2024, $Pixels launches on Binance, Solana Pay disrupts Visa and Mastercard's empire

Hey everyone - it’s never a dull week in crypto and web3. From insider trading allegations, to a new acquisition, to projects shutting down - lets go through the top six stories in crypto from the past week.

TOP SIX STORIES IN CRYPTO

Yuga acquires Moonbirds & Proof from Kevin Rose (ended up being controversial)

Allegations of insider trading around Yuga’s Moonbird acquisition

Main Takeaways from Yuga’s Town Hall

Are NFTs a viable business in 2024? Robotos NFT shuts down operations + Solana NFT CEO leaves 11 days post-mint

Web3 Gaming: Pixels token launches on Binance, after impressive user stats

Airdrop alert: Blast L2 (from Blur.io) is launching in February - sign up for BlastSwap early to tokens

1. Yuga acquires Moonbirds & Proof from Kevin Rose - (ended up being controversial)

Last week, Yuga Labs announced that they’re acquiring Moonbirds and the Proof ecosystem, from Kevin Rose (investor, co-founder of Digg). The move itself was questioning by many, for a variety of reasons. A big issue people had was the ethics of such a deal, meaning: “let’s bail out a founder from his NFT project - a project in which he raised tens of millions of dollars and delivered very little, from canceling their token airdrop plans, to axing the proof conference.”

With the acquisition - which was an all stock deal - Kevin Rose is free to walk away, unscathed, and pocketing millions of dollars while not delivering much at all. It’s understandable why the NFT community feels the type of way they do.

Prominent Yuga NFT holders went to twitter to vent their frustrations - while some outright sold their NFTs and left. Others spoke to the fact that the acquisition was a business-savvy move - Yuga acquires all assets from the Proof ecosystem, which expands the opportunity for royalties, once the Magic Eden Marketplace goes live February 27. Others also speculated that Proof held large reserves (estimates i’ve seen range from $10-$50M), which Yuga acquired as well as part of the deal.

To me, this suggests that Yuga is cash-strapped and needed capital injection to continue to build (reminder: they raised ~$400M in 2022 in a round led by a16z). Why didn’t they just raise more funds through venture? Well, because it’s obvious that the next raise would be a “down-round” - this is VC speak for: the company’s valuation dropped from the previous valuation of $4 Billion - that being confirmed in a VC raise would raise eyebrows, so better to get a capital injection by taking over Proof’s reserves.

Strategically, it makes sense (in a vacuum) - the move elongates your company’s runway, and also gives you more opportunity to collect royalties. Outside of the vacuum, is the reality that Proof and Moonbird is a brand with a strongly negative connotation, and widely seen as a grift ran by Kevin Rose. That’s part of the blow back Yuga is currently experiencing currently, which they’ve taken steps to address, from calling holders personally, to holding a Town Hall this past Saturday.

And if there wasn’t enough drama around this, there’s been some allegations that news of the acquisition leaked early which led to a lot of Moobird sales in the days leading up to the announcement - i think that’s called “insider trading” - see the next story.

2. Allegations of insider trading around Yuga’s Moonbird acquisition

Before the acquisition of Moonbird’s was announced by Yuga on Friday, the Moonbird trading volume started to pick up rapidly (see the graph below). Once the acquisition was announced on Friday, it was obvious the word got out and many people were engaging in what you might call “insider trading” - i.e. trading in a public market with non public information. It’s bad because in the game of trading, it gives you a massive advantage, and it’s also illegal. Nate from Opensea is in jail for exactly this.

How did the leak happen? There’s lot of theories, but it’s best to track the flow of information. I break down a possible route of how information got out in my thread here.

3. Main Takeaways from Yuga’s Town Hall

After a tumultuous Friday, Yuga labs decided to hold a town hall call in their Discord Saturday night, where they would answer questions from the community surrounding the Moonbird acquisition and the overall direction of the BAYC. You can listen to the full recording here.

A few key takeaways

The Moobird acquisition did come with a sizeable amount of cash that Yuga is absorbing

Kevin Rose will not be joining Yuga Labs, he’ll be an advisor

Dan Alegre is excited by the web3 native team at Proof (rip 10KTF’s web3 native team)

BAYC is working on an IRL clubhouse in Miami

I thought the Town Hall went fine - there wasn’t anything brand new that was explored, and Dan clearly reading a script in his opening came across as a bit stiff, but I get it - these was a high stake situation, and you can’t take any chances on that.

4. Are NFTs a viable business in 2024? Robotos NFT shuts down operations + Solana NFT CEO leaves 11 days post-mint

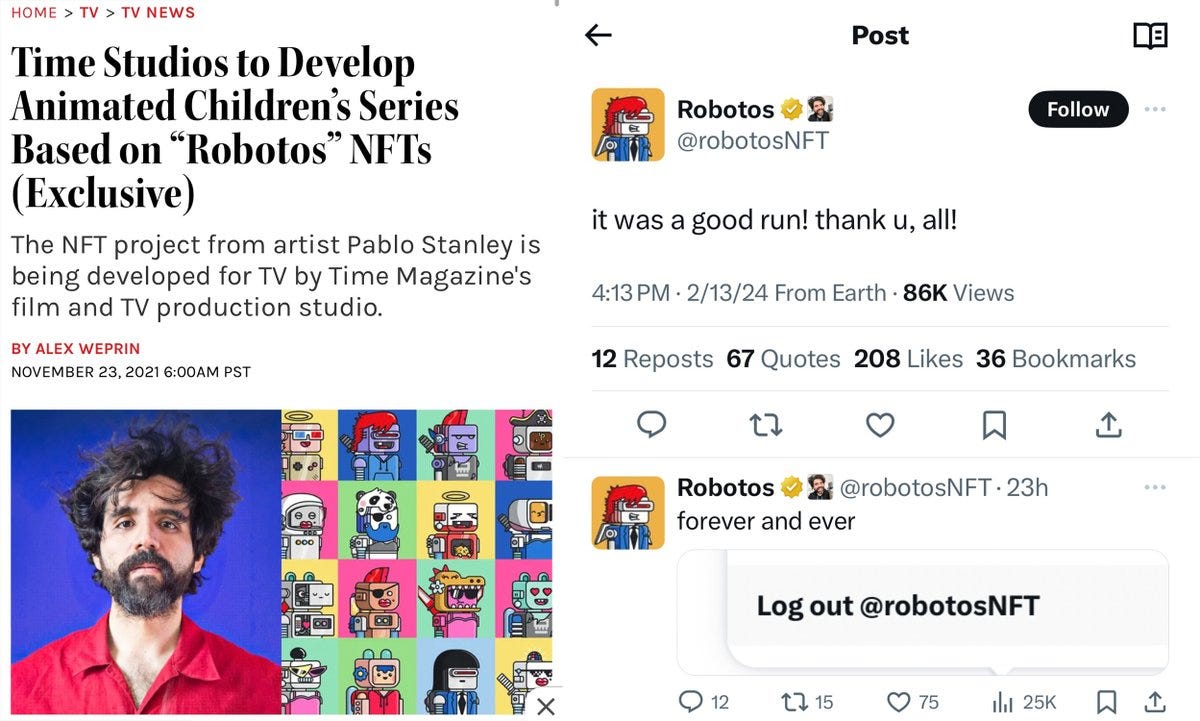

Two big NFT projects (one from 2021, another from… *checks notes* last week) just called it quits. Robotos by artist Pablo Stanley minted in 2021 and collected $1.5M during the mint; despite also having a Time Magazine partnership to develop a Children’s series (below, left) the founder said goodbye “forever and ever” (below, right).

Teddies, a project that minted on Solana minted NFTs and collect $1M last week. Days later, he published a letter saying that he’s “hit his limits” and that “he’s not the right person to lead it”. Now, this project isn’t ending, it’ll continue on with the team that’s still there and possibly a new CEO, but this is slowly becoming a trend in the space. Above we saw Kevin Rose fail in leading Moonbirds and calling it quit via an acquisition. Pablo Stanley did not want to take the acquisition route with Robotos and chose to end it the project all together.

All this to say: are NFT projects really a viable business? There’s a lot that comes with them when you think about it.

Take for example, the fact that every time someone sells your NFT at the top, there is another person on the other side of that trade, that is losing if the price doesn’t continue to go up, or they don’t derive the value they think they should from that purchase. The person with the high sale is on their way out, but the person buying is now here, waiting for “value”. How do you as a project, continue to deliver an endless stream of parties, utility, and overall “value” to your holder base - especially in a time where royalties have gone to 0?

NFT projects can easily sell and generate $1M of revenue in minutes, and that attracted a lot of people to it. But there’s an ugly side to accepting that money, and that’s being tied to the project with a community that demands you do something with they money the spent. If you don’t, they’ll be at your neck. That doesn’t sound all that appealing to me.

5. Web3 Gaming: Pixels token launches on Binance, after impressive user stats

Pixels is launching their coin $PIXELS on Binance today. They’re a fun casual game with over 180K daily active users, trying to bridge the gap between web2 and web3 games. It’s free to play on over at pixels.xyz - I participated in their “play to airdrop” campaign in January, which allowed for anyone to get an allocation of $PIXEL - to be honest, I had a lot of fun playing for those 2 weeks, and reaching the top of the wood cutting chart. Going forward, the game will have quests and campaigns you can do to earn $PIXEL - it’s led by Luke, a brilliant CEO with a drive to prove to the world that web3 Play to earn games can be sustainable. The game and the token will be one to watch.

6. Airdrop alert: Blast L2 (from Blur.io) is launching in February - Sign up for BlastSwap early to tokens

Blur’s layer 2 solution BLAST is just around the corner (expected to launch end of February). With that, there is a whole ecosystem already being built on top of it. Think DEXs, NFT marketplaces - the works. Because it’s so early in the game, many of these teams will want to attract new users to their website - which is why BlasterSwap (a DEX like Uniswap on Blast) is offering a referral airdrop reward. Sign up for BlasterSwap (my referral link), and you get a piece of their token when it drops. You’ll get your own link which you can use to refer your friends too, which can boost your reward as well.

Next week, I’ll write more about Blast L2 - in short though: it’s got $1.5B in funds already locked up which people can start using by the end of February - from memecoins, to NFTs, to everything in between, there’s going to be major activity happening on blast which you’ll want to be a part of. You can still bridge ETH to Blast right now, which will get you $BLAST in may (separate from BlastSwap) - i’ll leave a few links here, here and here, which you can use to get early access to Blast. Once you join, deposit some ETH (it’ll be locked up until end of February, aka when the L2 launches). If the codes above don’t work, reply here and I’ll send you one personally.

Lastly, I’ll leave you with a post that made me realize the potential of blast - read it here or click on the image below.

That’s all for this week - See you next time. and hit the subscribe button, por favor.

- atareh out