Luna/UST: The Big Short Style

The Terra blowup had a lot of similarities to The Big Short (2015). So I thought: what if Jared Vennett told this story?

Hi everyone,

I’m sure you’ve heard and listened to different takes about the Luna/UST blowup from the past week. At the risk of adding one more interpretation, I wanted to share what I noticed: many parallels between this story and the 2008 housing crash. From the bravado to the early signs to the people warning (and betting) against conventional wisdom (housing is stable/UST is stable!).

And no one told the story of the 2008 crash more brilliantly than The Big Short (2015) by Adam McKay. So, here’s my take on the Luna/UST crash, written in the voice of Jared Vennet. If you haven’t seen The Big Short, please make the time to. You won’t regret it.

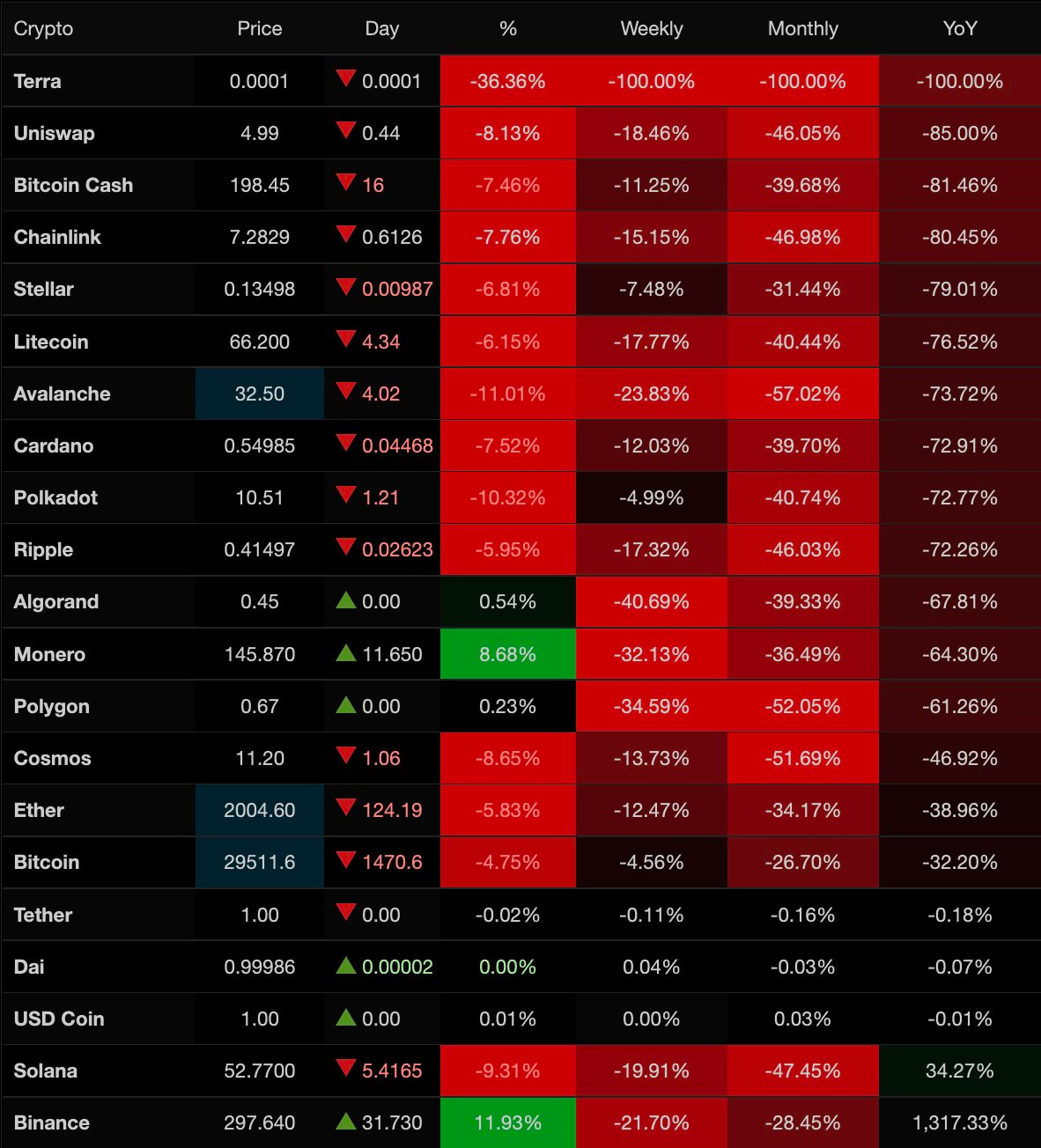

Last week, 60 billion dollars of market cap was wiped out in crypto. This is the story of one man's stablecoin, which mutated into a monstrosity that collapsed the entire ecosystem and caused a massive crypto downturn. This is the story of @stablekwon and the Terra.

So what really happened? I'm guessing most of you still don't really know. Yeah, you got a soundbite you repeat, so you don't sound dumb, but cmon.

The collapse blindsided most people; some did see it coming. While the #LUNAtics were having a big old party, some saw the giant lie at the heart of the Terra. A few weirdos and outsiders saw it early on and tried to warn everyone. We'll meet them later.

Now before I get into the guts of this story, fair warning, you're going to hear a lot of DeFi terms like:

Stablecoin

Peg

Collateral

Algorithmic stablecoin

Marketcap

APY

It's pretty confusing, right? Does it make you feel bored? Or stupid? Well, it's supposed to

DeFi loves to use confusing terms to make you think only they can do what they do. Or, even better, for you to leave them the fuck alone. But unlike The Big Short, we don't have Margot Robbie in a bubble bath to explain; you're stuck with me.

So, here's what you need to know:

Stablecoin: a crypto coin that matches the value of fiat (usually USD). It helps normies use crypto because it's familiar and not "volatile" 🙄

Peg: to match a value. UST was "pegged" to fiat USD so 1 UST *was* always = 1 USD

Collateral: proof that an asset is worth something because something else is backing it up (ex: when you buy USDC stable coin, they buy $1 fiat USD to keep in the bank)

Algo stable coin: a stable coin backed by user incentives instead of collateral or reserves

Marketcap: the price of a coin * total available coins. How much a cryptocurrency network is worth

APY: annual percentage yield. They are commonly used as a reward for "staking" your coins to get free cash at a percentage.

Now, let's jump into the story.

Terra labs launched at the peak of the last crypto cycle

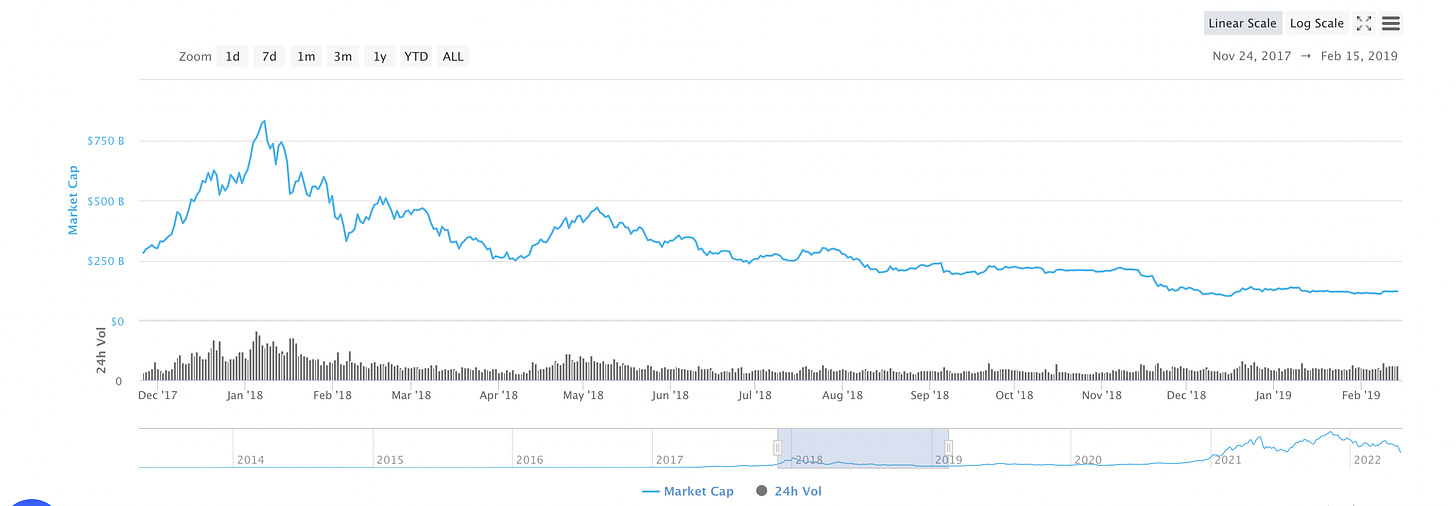

Terra was founded in January 2018, at the peak of the 17/18 bull run. At the time, ETH was not the second-largest cryptocurrency (surprisingly) - it was XRP (remember them?) Things were very different back then.

In hindsight, Jan 2018 turned out to be the top. The total crypto market cap peaked at ~$800M in Jan 2018 and would proceed to bleed out to ~100M over the following year. Many learned in the months and years to follow that what goes up must come down.

And because bear markets are for builders, that was Do Kwon's mindset (@stablekwon). Kwon took on the position of CEO of Terraform Labs to build: "a protocol to create decentralized price-stable cryptocurrencies (stablecoins) to usher in crypto payment processing."

Their plan was simple:

Launch a coin to fund development

Launch stablecoins

Create a DeFi ecosystem to sustain their community

???

Solve the global payments infrastructure

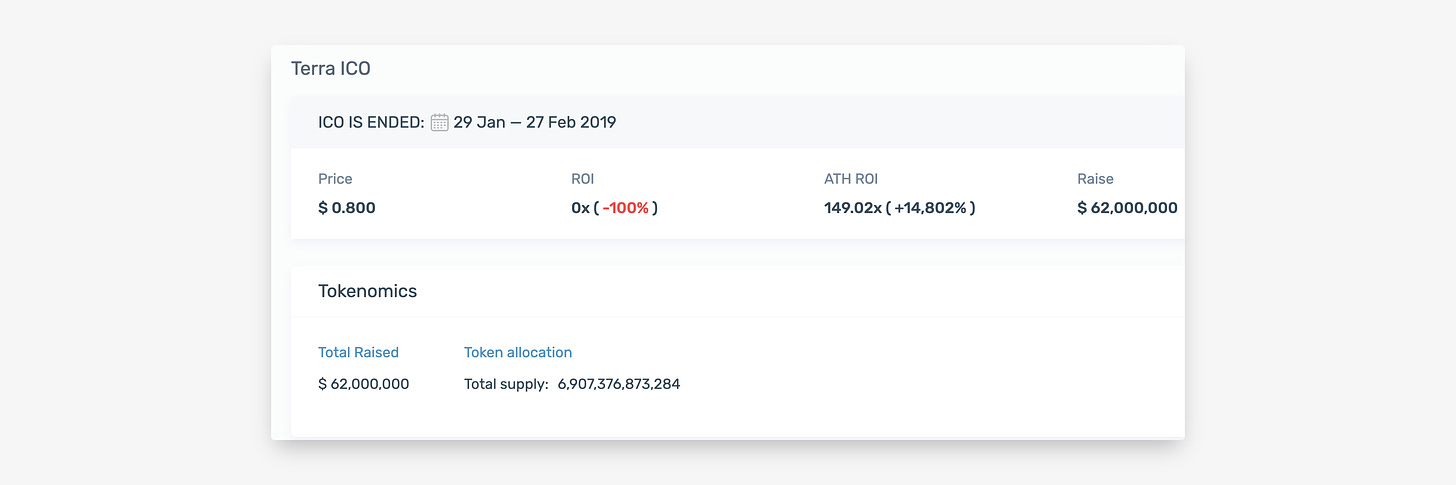

Specifically, the coins they launched were LUNA and UST. LUNA held their ICO in Jan 2019, letting early investors buy LUNA for $0.80, which got them $62M.

Then, a year and a half later, Terralabs launched their algorithmic-backed stable coin TerraUSD (UST) in September 2020 (fun fact: they also launched TerraKRW, a Korean won stable coin earlier that year and spoiler: same fate as UST).

Terra’s mechanics were fundamentally flawed.

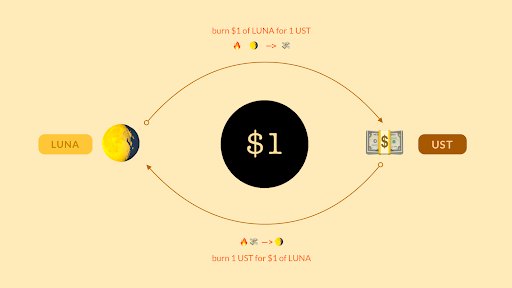

The idea of LUNA and UST was simple enough. Since UST should always be $1, which is dictated by how much UST is out in the market, Terra designed a way to mint or burn UST.

When the price of UST is> $1, you could burn LUNA to get an equivalent value of UST. Why? Because there was an arbitrage opp: if 1 LUNA = $50, you get 50 UST for burning LUNA; if the UST price was $1.1, then you sell 50 UST for $55. This selling pressure would balance UST back to $1

and the opposite works as well; if UST is at $0.95, then the arbitrage is to buy UST for cheap and burn it for $1 LUNA. In the terra ecosystem, burning always gives you the $1 quote price, irrespective of the market price.

Again, this mechanism was built into their ecosystem and designed always to ensure that 1 UST = 1 USD

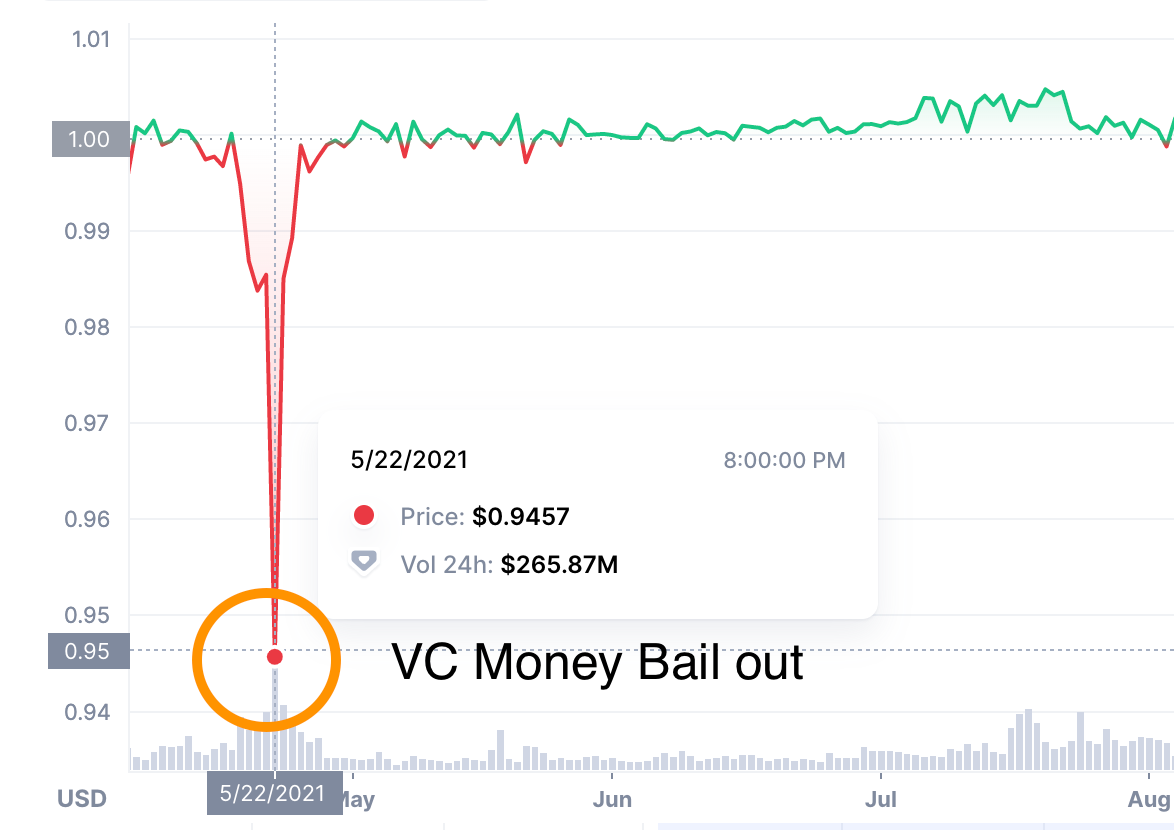

But how well did that work? Did UST ever depeg from $1 before? Well, yes, and guess what bailed it out? Not the proposed LUNA <> UST burn mechanism...

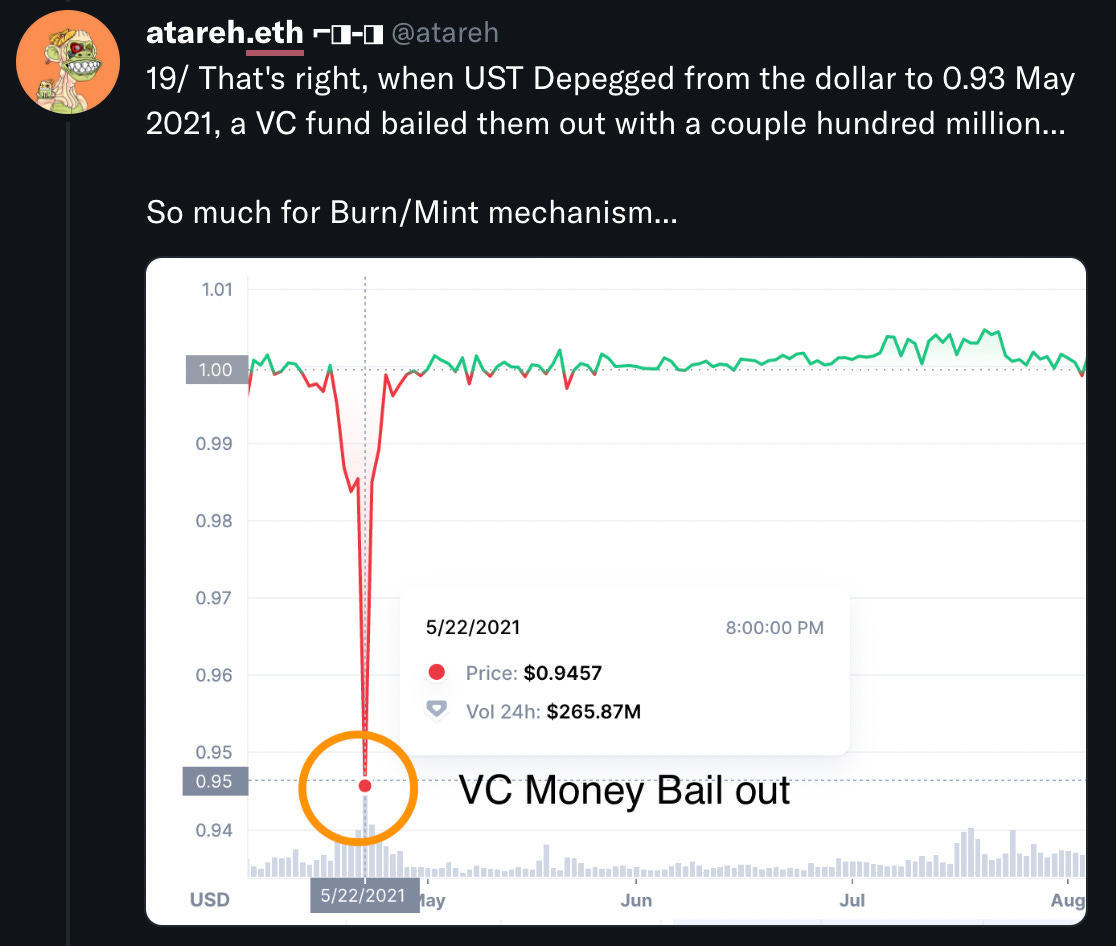

That's right, when UST Depegged from the dollar to 0.93 May 2021, a VC fund bailed them out with a couple hundred million... So much for Burn/Mint mechanism...

But let's put that aside. That's one day and only one depeg event. The Terra ecosystem is robust. Ethereum was hacked before, too and look at it now. And besides, have you heard about their savings program? No? well, let me tell you all about it!

Anchor protocol: the Ponzi of all Ponzi

If the instability of UST didn't raise alarm bells, how does free money sound? Terra's first main product was a "savings platform" called Anchor. They promised you 20% APY on a stable coin. Let me be very clear: that 20% APY is ABSURD, especially for a stable coin.

That is the literal definition of Ponzi - because you were incentivizing people to hold and stake your currency so that they could get more free money, all the while promising that UST currency will always be pegged to the US Dollar. (🚩🚩🚩🚩🚩)

While Terra said that the Anchor protocol made money and 20% was sustainable - that was a lie. They were dipping into their reserves of LUNA and selling it to give people a 20% annual return.

But once again, nobody gave it any thought. Free money, right? At its peak, just before the crash, Anchor held 14 Billion dollars in UST.

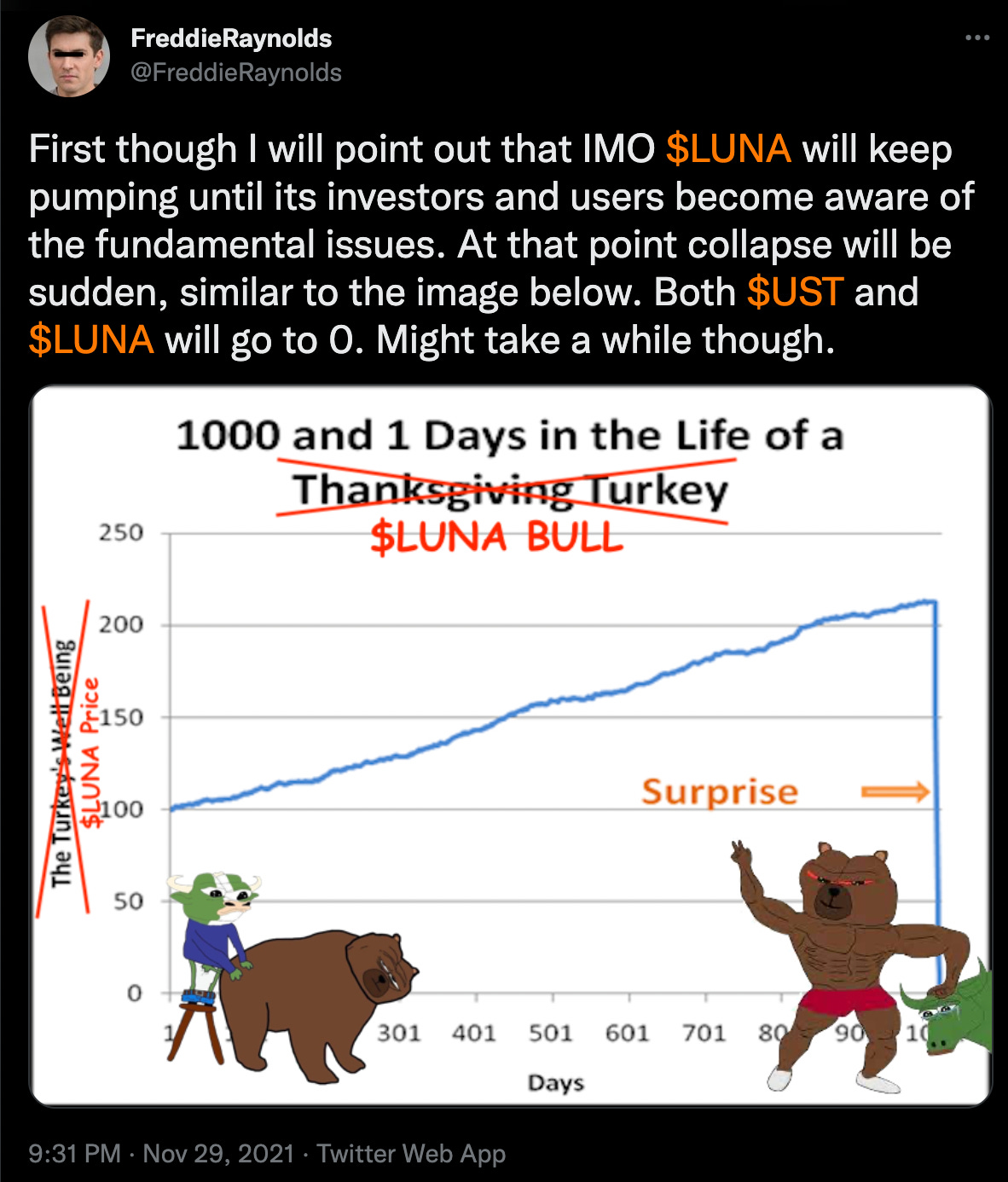

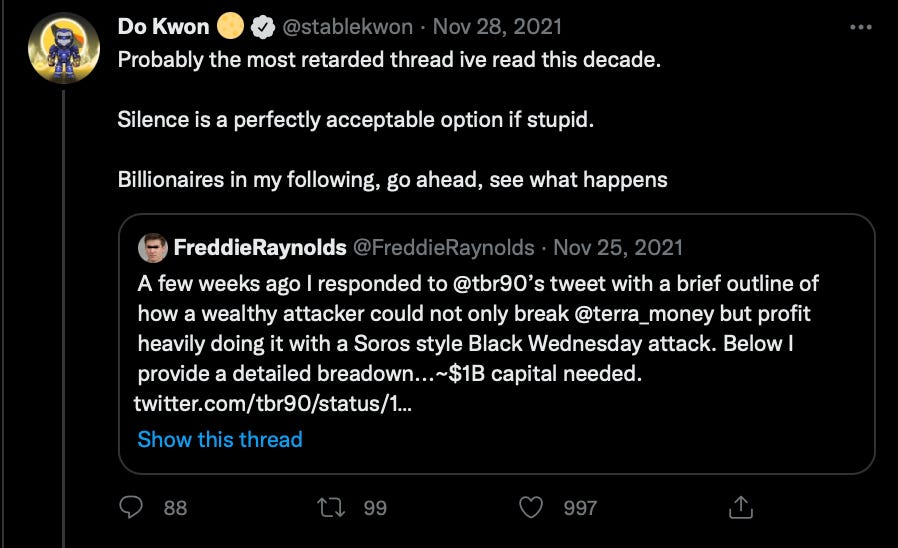

And it's at this point in the story. I should formally introduce the Michael Burry of this story: @freddieraynolds. Before the 2008 financial collapse, Burry was one of the first to notice that the housing market would collapse and proceeded to short the banks.

The weirdos and outsiders that saw the disaster before it happened

I'll be honest - I don't know much about Freddie except that he called out how vulnerable Terra was in November 2021, and for that, he was called "stupid + [redacted]" by Do Kwon 😂

What triggered Do Kwon to turn to 5th-grade insults was that @freddieraynolds detailed a plan on how someone with ~1 billion dollars could destroy the Terra ecosystem (while making a shit tone of money too)

The plan was honestly simple - you can read the entire thread below, but in short, it's: destabilize the UST $1 peg by repeatedly buying, selling and converting a large amount of LUNA to UST. Do this enough, and you'd start a death spiral.

Why would this work? Well, remember what I said before? The depeg to 93 cents in may of 2021 was solved by a VC fund dropping hundreds of millions to rescue it, NOT the mint/burn mechanism (Not very stable, @stablekwon).

But even still, nobody believed @freddieraynolds - or at least very few people did. Do Kwon responded professionally (for once) and still said this sort of attack was impossible.

And yet, here we are, with LUNA and UST sitting close to $0. It's hard to say if someone deliberately used Freddie's thread as a blueprint to attack the Terra ecosystem, but we do know that a giant whale with $1 Billion in UST started the initial depeg on May 7

That would be the last day UST would hit $1 because as each day passed, more and more people panicked. The longer the price stayed below $1, the more people pulled their UST out of anchor, which led to more people selling. A death spiral, just like @freddieraynolds said

All it took to break a 60-billion-dollar ecosystem was an opportunistic attacker with a billion dollars. Was it an attacker? Where did they get that from? Is Citadel behind this? or eas it the US Fed? Conspiracies have been running wild, but it misses the point entirely.

When you play the game of crypto, you win, or you die. If your ecosystem can be taken down in such a fashion, it shouldn't have existed in the first place. Financial systems should be anti-fragile - they should be able to take on little tremors and big earthquakes.

Otherwise, you will get exposed, which is what happened here. But why did the overall crypto market drop that week as well? Well, the market was already headed down because the US increased interest rates, but of course, Do Kwon's actions played into this.

In January 2022, Do Kwon started buying BTC - to be put in the Luna reserve as collateral... (Sidebar - I thought this was an algorithmic stable coin, Kwon... I thought it didn't need collateral... wasn't that your whole point? Why you gotta ruin my BTC bags too 😭).

In total, the Luna Foundation Guard (LFG for short... smh🤦) amassed 80,000 BTC or 3 billion dollars. So, they bought a wildly volatile asset to backstop their unstable stablecoin, which they thought was a good idea.

So, when the market downturn started on May 7th, along with the UST attack, they had to start selling their 3 billion dollars worth of BTC to "defend the peg" This meant there would be 3 billion dollars of selling pressure in Bitcoin.

So like any good trader, people sold or shorted BTC too, which dropped it 25% from 36K to a low of 26K in 1 week.

This is a long thread, and it barely even covers the surface of what happened in the Terra ecosystem, but this implosion has brought the world's attention onto crypto and web3 - and once again, for the wrong reasons.

There is now talk of major regulation coming to stablecoins, stories of people committing suicide and who knows what else.

Ultimately, it’s not Do Kwon, Terra, its employees, or their investors that held the bag. It was regular people - people that bought into a vision. People that hoped for a better life - and they were screwed.

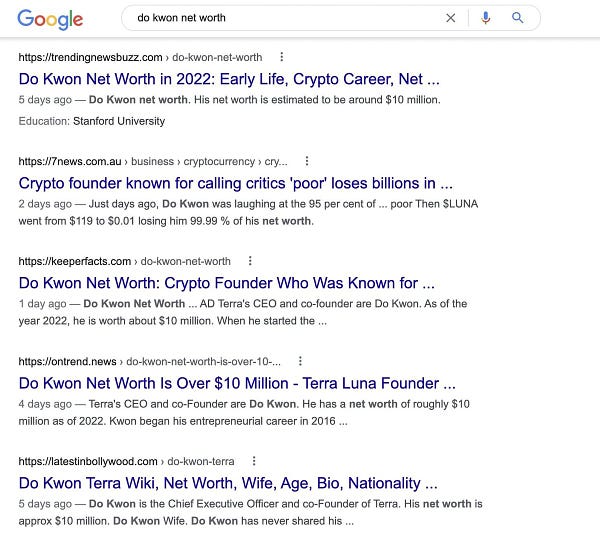

What's going to happen? Should someone go to jail? Why is Do Kwon paying people to publish articles that downplay his net worth?

I don't have the answers, but I hope something meaningful happens and people are made whole somehow. Whenever an irresponsible actor comes into the space and promises riches and ultimately fails to deliver, more people get turned off and burned by web3.

We only have so many chances to get this right - so let's not get caught in the spell of a boisterous leader again. Let's put our money behind ethical people and ethical companies.

I also write on Twitter! Check out my thread on Opensea’s new procotol: seaport