Memecoins vs VC coins, Why projects without a founder perform better, Degen Chain | TS-011

Plus: the $62.5M Munchables saga, Blast's Community Memecoin Pacmoon, and a reminder to always stack sats.

TOP SIX STORIES IN CRYPTO

Retail is investing in Memecoins vs. VC coins

Munchables dev stole $62.5M, and mysteriously returned it

PacMoon - the community coin of Blast

Why projects without founders perform better

USD has lost 25% of its purchasing power since 2020

Layer 3: DEGEN Chain launches on Base

1. Retail is investing in Memecoins vs. VC coins

The memecoin supercycle is real - memecoins are running to hundreds of millions of dollars in just days, instead of weeks. Things are going parabolic and I think this is a wider trend we’re going to see this cycle.

Instead of buying venture capital (VC) coins, with “serious” pitches and actual “utility” - the curtain has been pulled back this cycle.

VC coins pump in a bull market because of the market is moving up, and when the 1- year unlocks end, they dump aggressively. See picture below.

Picking on Flow for a moment, was it really necessary? What did the blockchain truly enable that wasn’t possible on other chains? What was the purpose of the coin really? To create a cheaper faster ecosystem for NFTs, or to provide an exit strategy for web2 VCs to cash out through a token - something that would not be possible for DapperLabs (the company that launched Flow) investors through traditional means for another 5-10 years. As in, for Dapper Labs investors to get a liquidity event, the company would have to build an actual scalable profitable business that could be listed on the stock exchange.

Instead, many VC backed companies skirt that and push companies to launch a token. That’s Flow, and countless other VC backed coins.

Enter Memecoins. Instead of gambling on coins with “utility” (whatever that means), and praying you don’t get dumped on by people that are sitting on a 100x and counting down the days for their tokens to unlock, the playing field is leveled.

I’ll take it up another notch - all coins are memecoins (an idea). And the idea of governance tokens (like ARB) are failing compared to the idea of a community run (like WIF). Truthfully, neither have utility and the price action largely comes from mindshare. If mindshare is the real value driver, then i’ll pick the coin wif the hat than without everyday.

2. Munchables dev stole $62.5M, and mysteriously returned it

Last week, Munchables - a project on Blast - had $62.5M stolen. But the contract wasn’t exploited - the project’s dev rugged everyone.

How did this happen? Well, according to ZachXBT, the project hired a North Korean Developer. Instead of a smart contract to Blast (thereby making the code immutable), he pushed a “proxy contract.” A proxy smart contract’s code can be edited - that’s what makes it so dangerous. All the developer had to do was update the code, which allowed him to pull $62.5M in funds.

Friends of mine lost thousands, if not hundreds of thousands here. Cirrus - a guy who lost 300K - was still able to make light of the situation. But the night is darkest just before the dawn. and dawn for many was just a few hours away.

In a surprise turn of events - and for largely still unknown reasons - the developer decided to return all the funds without any ransom. Details on this is scarce, and I doubt we’ll find out what actually happened, but the North Korean dev lost a 3-1 lead to Pac-man and ZachXBT. Bullish

3. PacMoon - the community coin of Blast

If it’s not obvious, i’m very bullish on Blast - not just for the points and Blast Gold - the whole ecosystem. I’ll make a video about it after NFT NYC, explaining all the reasons why I think it’s going to change the L2 game and suck liquidity away from others.

But for now, we’re going to talk about the other opportunities available on Blast - specifically the memecoin economy. While I think DeFi will be the big driver on Blast, there must always be a memecoin. Memecoins help with adoption, ecosystem alignment and overall vibes. I explain it in full in my video below.

If you’re into Blast, keep Pacmoon on your radar.

4. Why projects without founders perform better

Frank - the founder of Degods - had an interesting tweet the other day.

The tweet + the two photos really paints an important picture of how many founders are ruled by overly emotional holders, but that’s a conversation for another time. I want to zero in on this line specifically:

We are in a market where projects that are free from execution risk are growing at faster rates than traditional teams (re: NodeMonkes, Milady, OMB, WIF, etc).

If you’ve been in NFTs and crypto, you know this inherently. Punks floor price has been consistently high for 3+ years (even during the bear market). Compare that to Bored Apes whose down to ~12 ETH now, way down from their high of 150 ETH more than a year ago.

So what’s really going on here? Is “execution risk” really the thing that’s causing traditional NFT projects to fail? While I think that’s definitely a part of it, there’s something else going on here - something deeper.

To explain, let’s go down a level and think from first principles

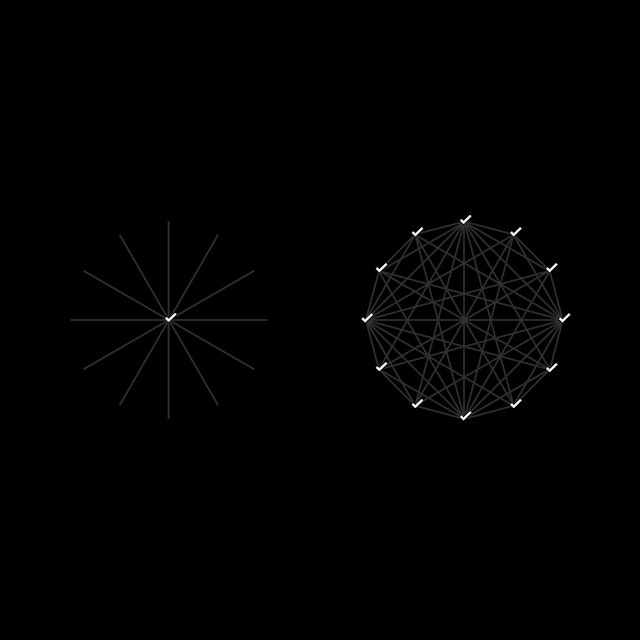

The Value of Networks

[disclaimer: this is a rough thesis, that i’m still working shopping. It’s my first time putting this into writing, and a polished version will be published as an essay at a later date. For now, indulge on my raw thoughts on this topic].

In a traditional NFT project (think Bored Apes, Pudgy Penguins), the structure is as follows:

Company X issues NFTs for $$$

Market participants decide to mint NFT based on “roadmap” or “utility” as defined by Company X

Based on the perceived value of “utility”, the floor of NFTs fluctuates up or down

In this set up, the dynamic is top down - similar to a traditional corporation. In it, the holders are more “customers” than collectors. This has many downstream effects, which is a direct consequence of the design of the system:

The holders wait on the company to ship something

Holders speculate on what’s coming next

When the company ships something, the holders get to create content (spaces, threads)

The whole NFT community also gives their take on what the company shipped (bullish/bearish)

The important is that, the design of traditional NFT projects is one-way. Company creates [thing] to give to holders → holders like it or hate it → market speculates on whether [thing] is bullish or bearish → floor price moves up/down. In this system, the company is only as good as it’s last at bat (similar to a publicly traded company - have a bad quarter and your stock tanks). Only the company can create value and therefore the NFTs floor will live and die by the decisions of the company.

Compare this to NFT projects without a company behind it. How is value created in a project like CryptoPunks or NodeMonkes? The value is the network itself. It’s in the people that hold that NFT. It’s in each individual that decides to create value for the network.

Take the Redacted Remilio Babies. It’s well known that the niqab trait Remilios run memecoins. They are behind some of the biggest launches (most notably, PEPE last year). If you hold a niqab Remilio, you *might* be let into the groupchats where most of these memecoin cooks are created. Buying one isn’t cheap, the floor is 8.5 ETH ($30K USD) - but money isn’t the only barrier to get into niqab group chats. You have to be vouched for, you have to be “based” in the eyes of the current holders. If you’re let in, you will make a lot of money in crypto.

The value in Remilios and specifically the niqabs, is divergent behaviour of an open decentralized network. Value is created within the network, for the network, by the network. The founders of Remilios never set out to attract a network of based memecoin devs, this happened organically.

This is why NFT projects without execution risks perform better than ones with a company: they tap into the true nature of internet based networks. Value for the network can be created by the network - there is no top down structure. It’s complete freedom to create for the community you’re in, without constraints.

While traditional NFT projects have had a network like this - where each node creates value for the whole network on their own volition - the design of the system (top down value creation) decays the network, and attracts passive participants that want to be rewarded vs value creators.

[rough thesis and still working on making the argument more concise, but this is what I think is actually happening - please send thoughts, rebuttals!]

5. USD has lost 25% of its purchasing power since 2020

Reminder: stack sats.

In the heat of memecoin and altcoin mania, don’t forget the real game you’re in - to stack the majors assets in the space, particularly Bitcoin. Since the Fed started money printing in 2020, the US Dollar has lost 25% of it’s purchasing power, while Bitcoin has increased 800%. The store of value narrative around Bitcoin is very real. If you can’t participate heavily in the crypto markets, then storing some of your money in Bitcoin is always wise.

Watch the full video below:

6. Layer 3: DEGEN Chain launches on Base

If 2 layers weren’t enough, we’re now 3 layers deep on Ethereum. Last week, Degen, a coin on Base (and deeply integrated with Farcaster), launched their own chain ontop of Base: Degen Chain.

This is the first Layer 3 on Ethereum, and the main use case is: degening. Speculating on memecoins.

From what I’ve read, Degen Chain is really just a centralized database running ontop of Base. Meaning, the founders can control what happens on it - if there’s an exploit or a hack, they can reverse transactions. I don’t think that’s going to happen or relevant, but it is important to understand the nature of what you’re using.

The base currency/gas token on Degen Chain is the Base DEGEN token itself. Meaning, whenever someone bridges their ETH from Base to Degen Chain, they are market buying the DEGEN token - which has caused the price of Degen to skyrocket.

Bridging into Degen Chain takes a few minutes, but bridging out currently takes 7 days - which may seem like a bug, but it’s a feature for the chain itself. Money can fly in easy, but will exit slowly. It’s the ultimate memecoin arena. An arena built by DEGEN, for Degens.

As always, if you found value please share with a friend or tweet this out. Thank you for your attention.

- atareh

Disclaimer: This commentary is provided for general informational purposes only and does not constitute financial, investment accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this commentary should consult with their advisor. All opinions and estimates expressed in this commentary are as of the date of publication unless otherwise indicated, and are subject to change. Certain information that we have provided to you may constitute “forward-looking” statements. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual results or achievements to be materially different than the results, performance or achievements expressed or implied in the forward-looking statements.