The problem with NFT reveals Part II: a better way to reveal

The better way to reveal NFTs is a nod to good design and fosters human connection. No, i'm not overhyping burn-to-reveal.

Hey everyone, the long-awaited part 2 of the problem with NFT reveals is here. This was a fun one to write. If you enjoy it, share it on Twitter and tag me (@atareh). And subscribe if you’re new. Do it, I’ll wait…

In part I, I talked about the problem with NFT reveals, in short:

The big exciting moment happens at the beginning of your project

You have no control over the reveal

Floors often tank after reveal collection wide

For 99% of NFT projects, this has been the standard. It’s checking the “upload art to IPFS and change the base URI on the contract” step, which updates the image on the NFT from the placeholder to the art.

But this is lazy. and we’ve known better - for quite a while actually.

The Mutant Ape Yacht Club Launch

Let’s wind the clock back to August 2021. Stephen Curry buys a BAYC for 55eth - he pops into Discord as well. That same day, Yuga Labs drops the Mutant Ape Yacht Club. Here’s how it went.

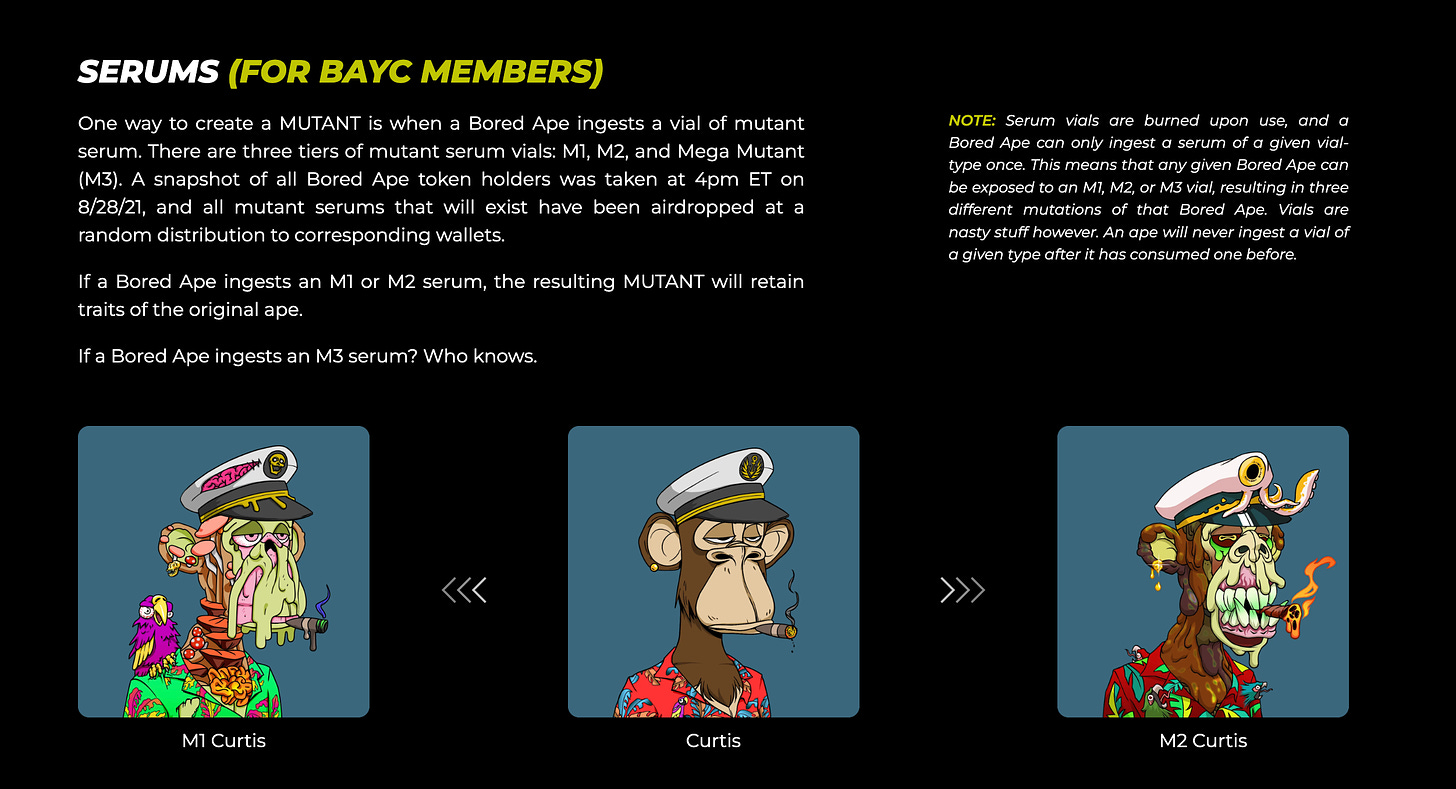

Each wallet holding a Bored Ape received an airdrop - 1 per BAYC held. But it wasn’t a Mutant Ape - they received serums.

To get your mutant, you’d head to their website, connect your wallet and burn one of the three NFTs that were randomly airdropped: M1, M2 or Mega Mutant Serum. By drinking your serum (i.e. burning), you were mutating your Bored Ape. All traits that your Bored Ape had were passed onto your M1 or M2 too - just more “mutant-ey.”

(Now, there are also the 10,000 non-serum mutants that were Dutch Auctioned off - on which I was able to mint one, but that’s an irrelevant but necessary detail to mention).

So what’s happening here? Why should this be the template to reveal NFTs, and why is this better than the standard design which I talked about in Part I). Let’s break it down.

Burn-to-reveal NFTs: a superior experience

The MAYC serums use what I call the “burn-to-reveal” mechanism. Burning to reveal is when you offer up an NFT (typically an ERC-1155 but ERC-721 also works) to a smart contract, to mint a separate NFT. The burned NFT and the NFT you receive back, are separate ethereum smart contracts (and therefore a separate Opensea page). For Bored Apes, there’s a page for the serums (the NFT that’s burned) and a page for the mutants (the NFT you receive after burning).

There are several reasons why this is a far superior method to reveal NFTs, than simply updating the metadata. Let’s break down each one

Holders decide when to reveal: Instead of revealing all NFTs at

[arbitrary date and time],you’re giving people the power to choose when to reveal. While most of my readers are North American and in an ET or PT timezone, web3 is timezone agnostic. I’m sure many people went to bed, only to wake up with a revealed NFT because they’re in a different timezone. This may seem like a small point, but it truly matters. Agency matters.The feeling of opening a present: Opening a gift is a universal human experience. Whether it’s a present on your birthday, Christmas, Hanukkah, or Eid - there’s not much that compares. Even opening up Pokemon card packs (like we did as kids), or more recently, opening VeeFriends cards (like we’re doing now as adults). People will pay extra for the feeling of anticipation. Burn-to-reveal brings this feeling to NFTs - give your holders the gift of opening a present.

Burn-to-reveal is a social event: NFTs run on social media (specifically, Twitter). We’ve seen how powerful the burn-to-reveal mechanism is in bringing people together. We had a massive Mega Mutant Reveal event last December, drawing in thousands of people to Twitter and Twitch. This energy continued on at ApeFest 2022 when another M3 serum was burned to reveal the gold Mutant. I’ve also taken part in this when we livestreamed 10KTF Combat Crate openings (which we dubbed “Cratemas”). This phenomenon continues with Renga, with Dfarmer.eth leading the charge with his “box smashing” Twitter threads. All of this brings people together to answer the simple question: “what’s in the box?” Which in turn brings hundreds if not thousands of interactions, views, likes and engagement on social media. This kind of attention often cycles into floor prices as well, where Renga isn’t doing so badly lately.

Increases the number of “metagames” in the project: Metagame means “the game within the game” - we’re all playing the Great Online Game, and within that, we’re playing the NFT game. You can go layers deeper though - which is what I’m about to do because this bullet deserves its own section.

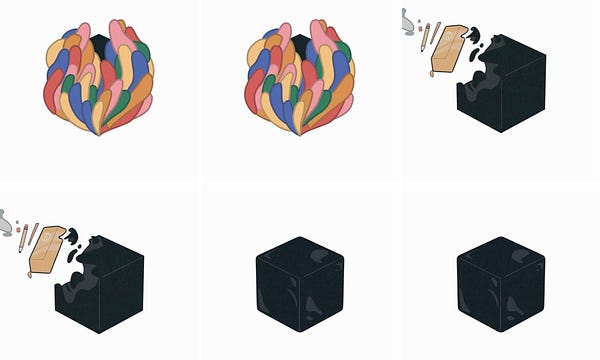

The games we play in NFTs

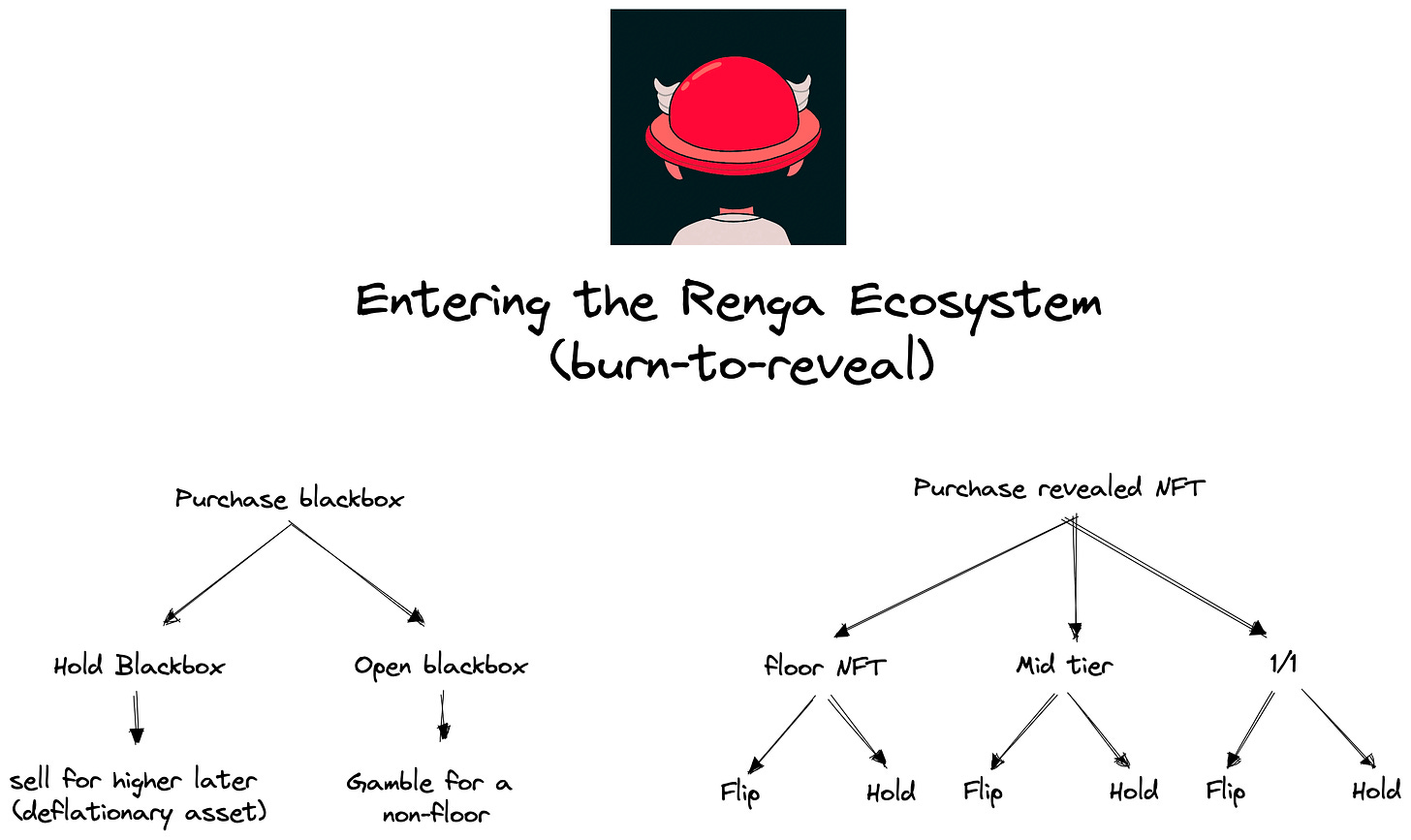

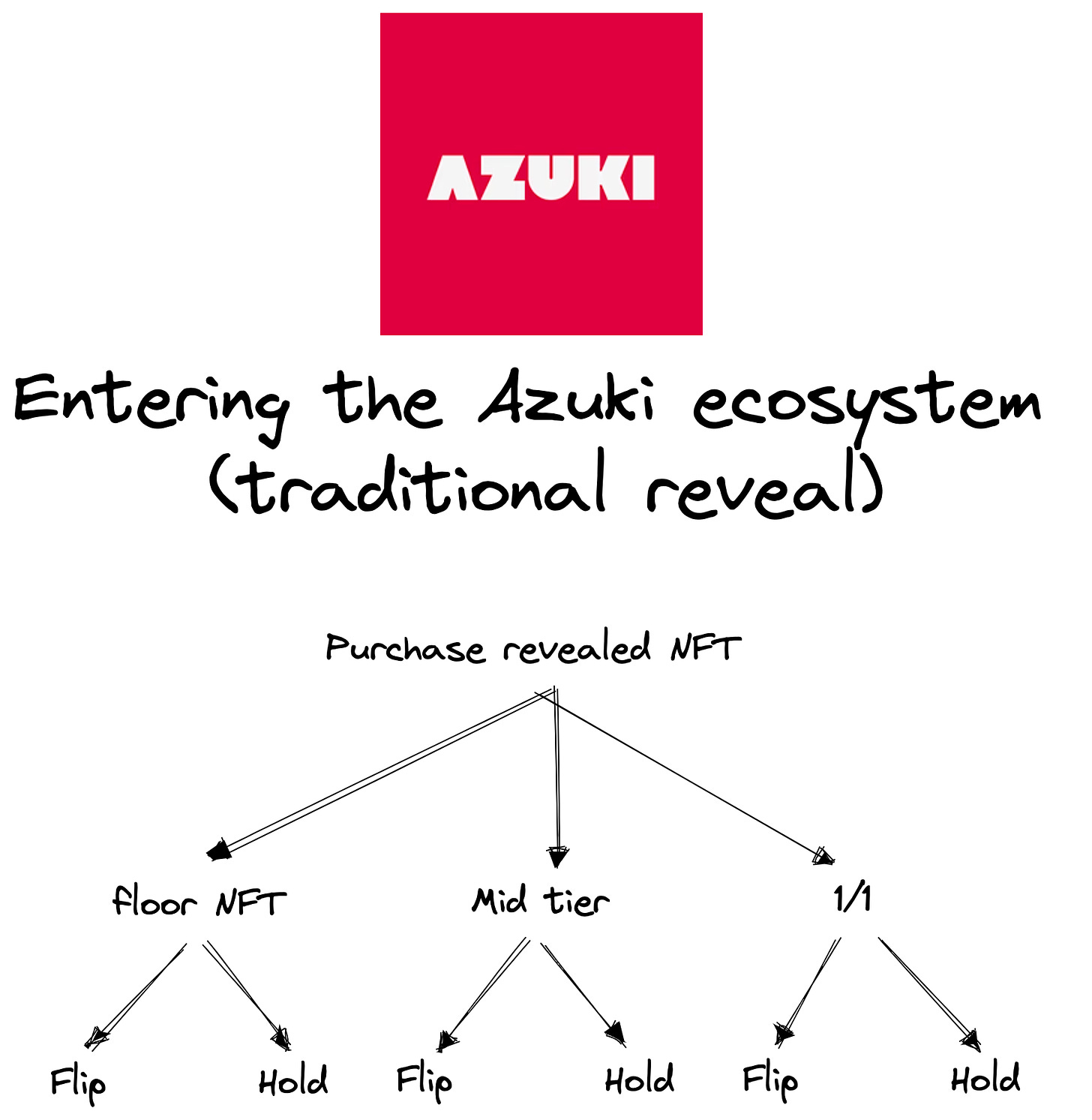

Within the NFT game, you have games you can play within a specific project to get a high score. An example of a game within a specific NFT project is hunting for and sniping rares. If you play this game, you believe that this NFT collection will increase in value, and when it does, flipping a rare NFT will get you better ROI than just sweeping the floor. That’s a different game than if you purchase NFTs off the floor to flip. During traditional NFT reveals, a game people play is: finding rare NFTs that are listed on the floor because the owner isn’t aware or they forgot to delist.” To win this game, you want to purchase this NFT for cheap and instantly sell it for its actual value (post-reveal, value floods to the rare NFTs in the collection). So where am I going with this? Well, in traditional NFT reveals, the “find a rare” game ends fairly quickly - you have a short window to snipe off the floor, but after that, the chances of you landing a rare without forking over lots of ETH is rare (pun intended). The burn-to-reveal mechanism preserves this game and introduces many others. For example, let’s talk about Renga. Renga NFTs has two NFT collections for their PFPs: Black boxes and the revealed collection. To enter the Renga ecosystem, you have some decisions to make: do you purchase an unrevealed black box in hopes that you reveal a non-floor NFT? Or do you purchase a black box to hold because it is a deflationary asset (the more boxes that are revealed, the fewer unrevealed remain on the market)? Or, you skip all of that altogether and purchase a revealed NFT off the floor, because you don’t want to pay the unrevealed premium (as of this writing, black boxes are selling for ~2x more than revealed Renga NFTs).

Compare the above to the decision tree for entering an NFT project that used a traditional reveal and it’s a no-brainer which mechanism projects should use. (This ties into a greater theory I have that the projects that incorporate interesting metagames are the ones that win but that’s a story for another time).

When comparing the decision diagrams for Renga and Azuki, I want to make sure the importance of the “hold black box” decision isn’t lost. NFTs are a financial game - the floor price is paradoxically the most important metric (“the floor is dropping delist!!!”), and the least important (“this project is best we don’t talk about the floor ever”). The importance of creating a deflationary asset in your ecosystem cannot be overstated. Let’s take a look at the mutant serums a bit closer.

Mutant serums: rewarding the 💎🙌

Now, let me preface all of this by saying: creating a deflationary arm in an NFT project means nothing if you don’t create value and give people a reason to buy into your project. The overall market cap of the project needs to increase over time so that the people that went long on your project and bought the deflationary arm of your project get their financial upside. There is no better case study than the mutant serums.

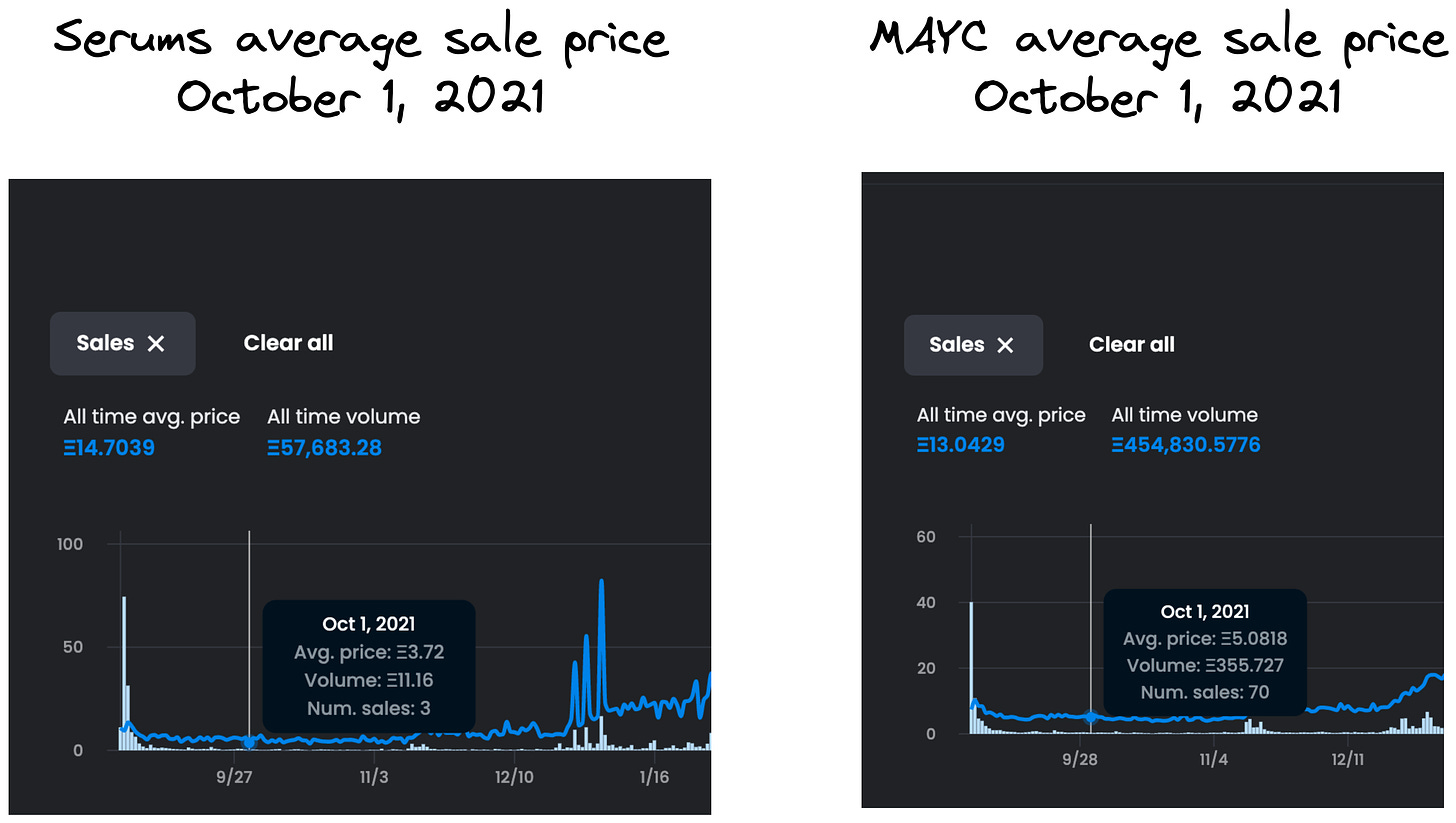

Today, the floor price sits at 34 ETH. 13 months ago, one month after they were airdropped, M1 serums were selling for ~4ETH (~1ETH lower than the floor price of MAYC at the time).

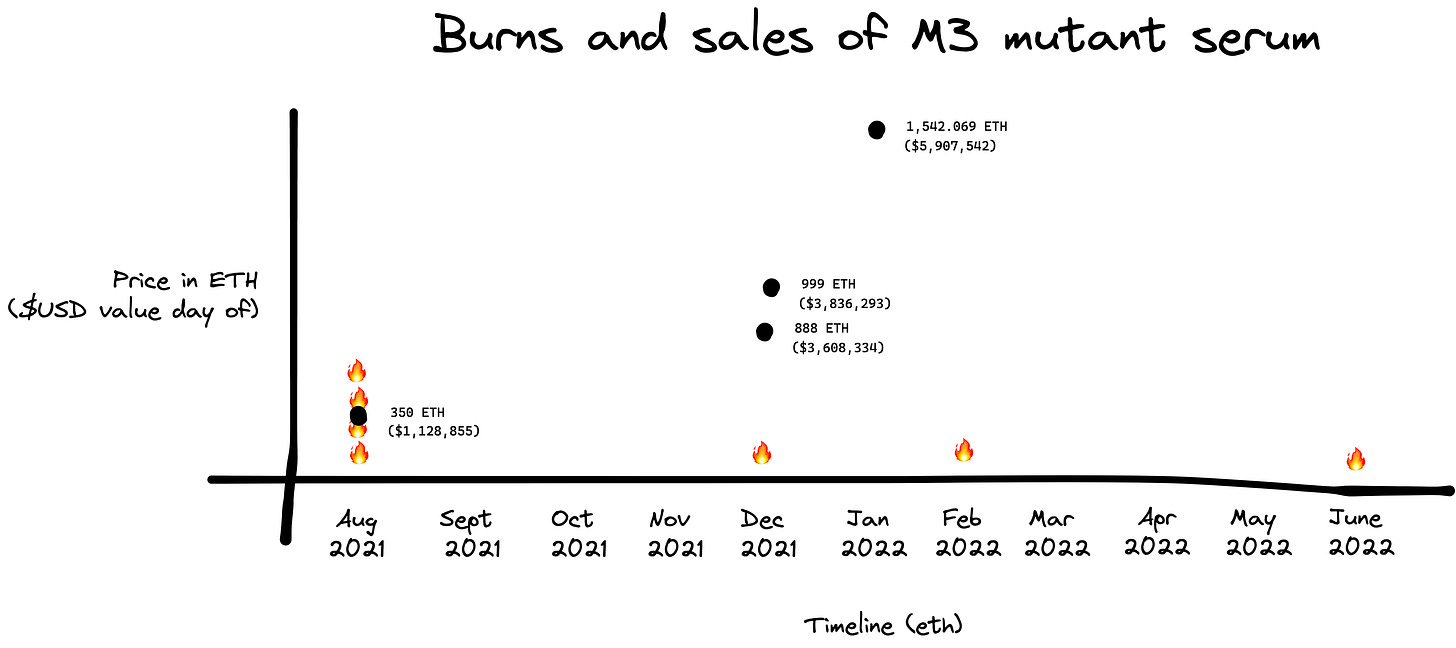

Now let’s be clear: if the MAYC floor dropped, so too would the serum floor price. They are inherently linked because using a serum on an ape would get you a MAYC NFT. So, the floor price of a serum follows the price action of the asset it gives. But because Yuga Labs became the Goliath in the NFT space and kicked ass, the floors for most of their projects look great (exception: Otherdeeds). If you wanted to bet on the upside of Yuga, a great play was to purchase an M3 Mutant Serum. Only 8 were airdropped to holders, four were used immediately and the other half were held. Today, only 1 remains. Let’s look at the price action of M3 Serums

The first M3 Mutant sale was on August 29, 2022 - it sold for 350 ETH ($1,128,855 at the time of sale). Four months later, there were two back-to-back sales for 888 ETH ($3,608,334) and 999 ETH ($3,836,293), on December 26 and December 29 respectively. The latest sale was days after the previous two, on January 2 at a whopping price tag of 1542.069 ETH ($5,907,542.97). What’s important to note is that, between September and December, there were 0 sales of M3 serum. In the days after the M3 Twitter space and Twitch livestream with tgerring.eth, we had consecutive record-breaking sales. Social events in NFTs really matter (perhaps this is the only thing that matters🤔). We are social creatures after all.

Connecting over shared experiences

The burn-to-reveal mechanism isn’t just about creating a deflationary asset to give your holders the potential for a big financial payoff sometime in the future. The actual M3 mutant reveal in December only lasted a few minutes. But in the hours leading up to it and after, thousands of people gathered. They gathered to tell their stories, of how they found the club, of the things they struggled with, and the belonging they found amongst internet strangers with monkey jpegs, deep in the throes of endless lockdowns. The Yuga Labs founders jumped on stage as well, revelling in what they had helped create over a short 8 months. I was there too, wondering if I’d ever have a bond like that with internet strangers (spoiler: it happened - we started a show together).

When you really think about it, the burn-to-reveal mechanism is actually about bringing people together. To give them a shared experience. To create memories that can last a lifetime.

Now that you know that, why would you do it any other way?

-atareh